Payroll News June 2025

Welcome to the June 2025 edition of JobBag Payroll News. Happy end of financial year to everyone! 🎉 Here's everything you need to know to prepare for EOFY and what's new in JobBag Payroll.

✅ Now Live: Support for Additional Employer Super Contributions (RESC)

We're excited to announce that Reportable Employer Superannuation Contributions (RESC) for additional employer contributions are now fully supported in JobBag Payroll.

These are optional contributions made by the employer - on top of the standard Superannuation Guarantee (SGC). They’re typically agreed individually and do not affect an employee's gross income.

Need help? See here how to set up and process Additional Employer super contributions (RESC)

Note: You will need to be on build 90104 to access this feature

📅 End of Year Finalisation – Due by 14 July 2025

Ensure your payroll is finalised and submitted to the ATO via STP by 14 July 2025.

📊 2025/2026 Tax Tables Now Available

The new tax tables, including HELP debt changes, have been published.

You will see this prompt when logging in:

“There are tax tables available for download. Do you wish to download them now?”

✅ Select YES

Or update manually:

- Payroll Menu > Update Tax Tables

Once updated, a JobBag notice will confirm the process is complete.

📈 Super Guarantee Increases to 12% from 01 July 2025

This is the final scheduled increase in the Superannuation Guarantee.

-

JobBag has already updated the rate in:

File > Configuration > Countries > Australia > Tax

-

A new Employment Info record will need to be added for each employee.

For employees with a Salary Package, review and adjust their salary package lines accordingly.

💼 Review Maximum Super Contribution Base

The maximum contribution base determines the quarterly limit for employer super contributions.

2025–2026 financial year, the cap will decrease —dropping to $62,500 per quarter from 1 July 2025

📅 Don’t Forget Public Holidays

Before running payroll, make sure all public holidays are entered into JobBag.

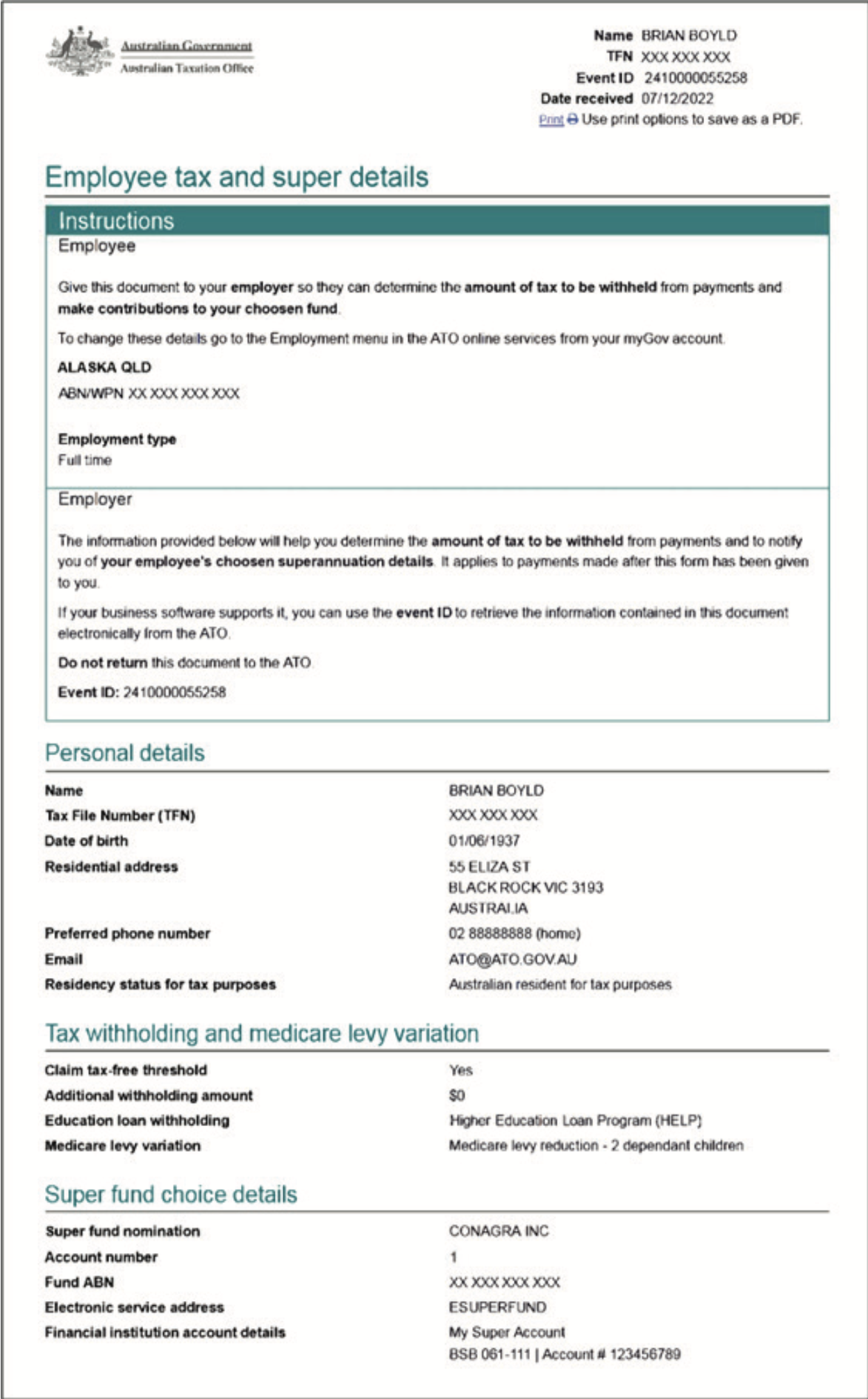

🧾 New Employee Tax & Super Details

New employees now complete the New Employment Form via myGov.

- They must provide a PDF copy to their employer.

- Instructions for employees: Completing the form using myGov

Employers can retrieve the employee’s tax and super info using the event ID directly in JobBag.

Note: The paper TFN form is only allowed for employees without internet or access to myGov.

✅ New Employee Onboarding Checklist

We’ve prepared a helpful checklist to streamline on boarding your new staff.

Organise training or need more help

Please contact support 02 8115 8090 or email support@jobbag.com