Process Supplier invoices - liable for WHT

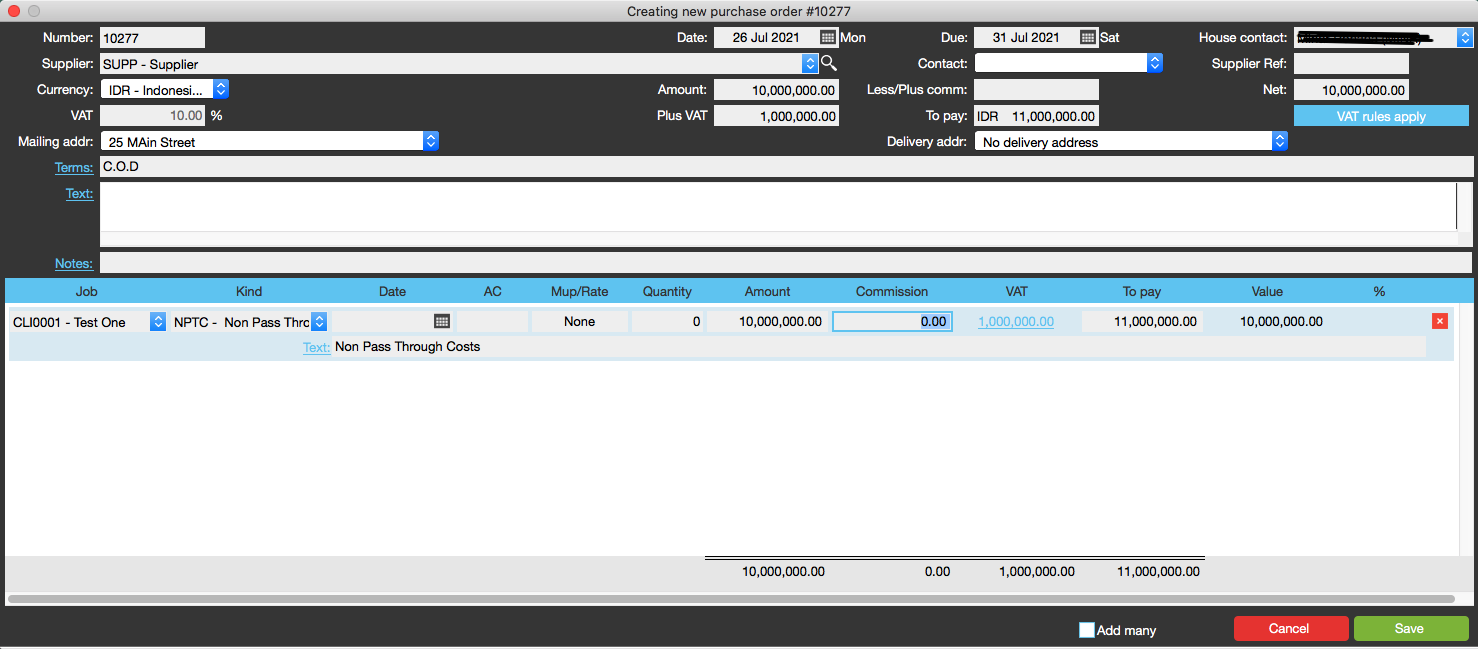

Create PO

Ensure supplier's VAT/GST status is set up correctly.

If a PO is created when the supplier was not registered for GST and you later find out the supplier is registered for GST, you have to cancel the PO update the supplier record to reflect correct WHT status and create a new PO.

WHT is not calculated on the PO.

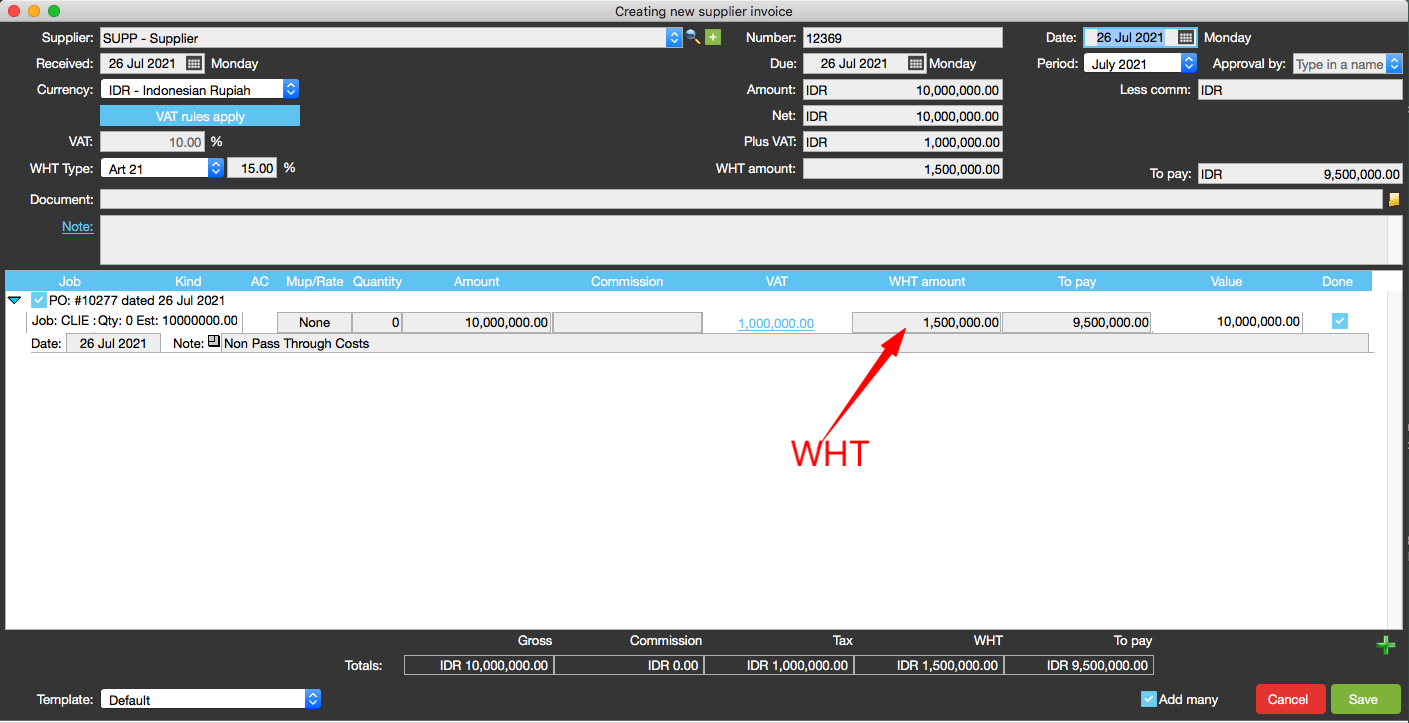

Create Supplier Invoice

In this example, the details are:

1 supplier cost is IDR 10,000,000.00

2 VAT/GST is IDR1,000,000.00 (10%)

3 WHT is IDR1,500,000.00

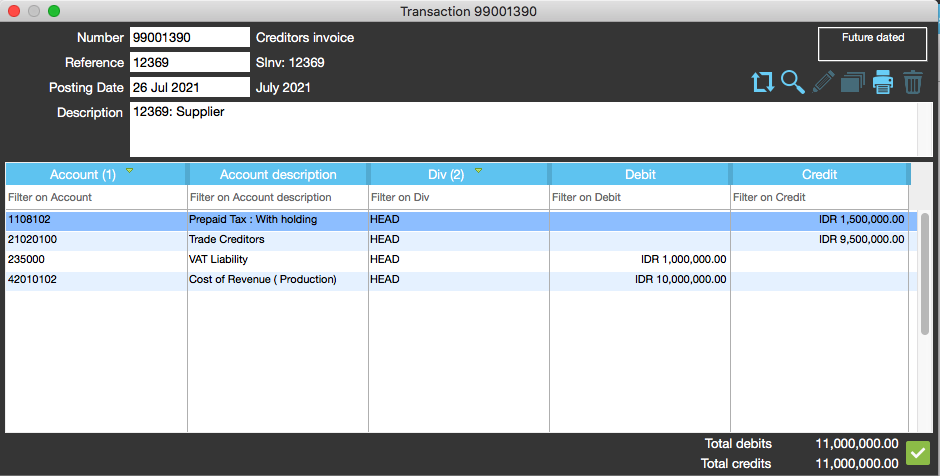

GL Posting

The amount posted to trade creditors is IDR9,500,000.00.

This is calculated as below:

WHT = 15% of Cost on supplier invoice i.e. IDR15,000,000.00

Trade Creditors = Original cost + GST -WHT (i.e. 10,000,000 +1,000,000-1,500,000)

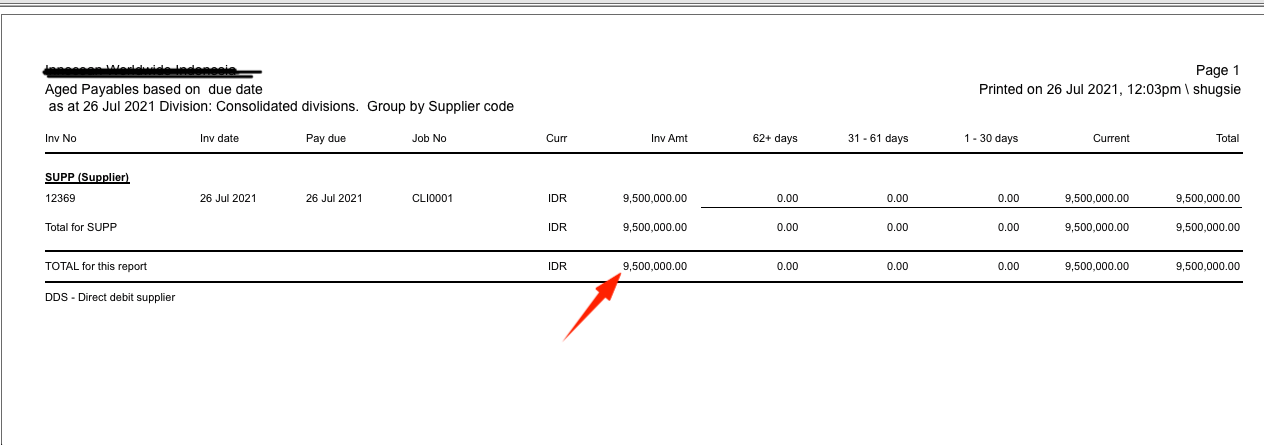

Aged Trade Payables

The amount payable is IDR9,500,000.00.