Process foreign Supplier Invoices where WHT is liable

Foreign Supplier Invoice - Supplier Liable for WHT

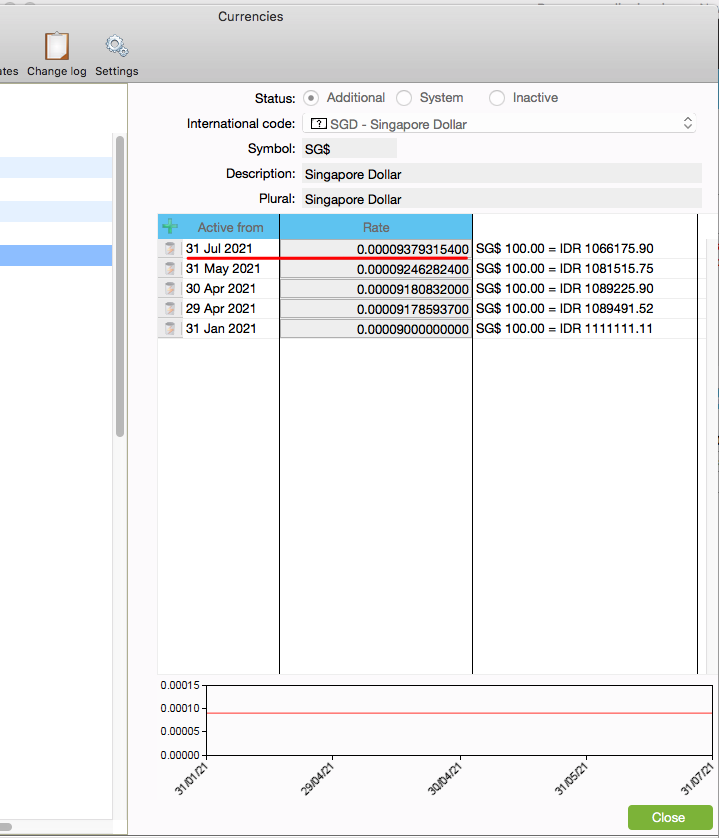

Ensure foreign currency rates are set up.

Refer to Configure Foreign Currency Codes for process. Note: WHT is NOT calculated on the PO.

Ensure supplier's VAT/GST status is set up correctly.

If a PO is created when the supplier was not registered for GST, and you later find out the supplier is registered for GST you have to cancel the PO update the supplier record to reflect correct WHT status and create a new PO.

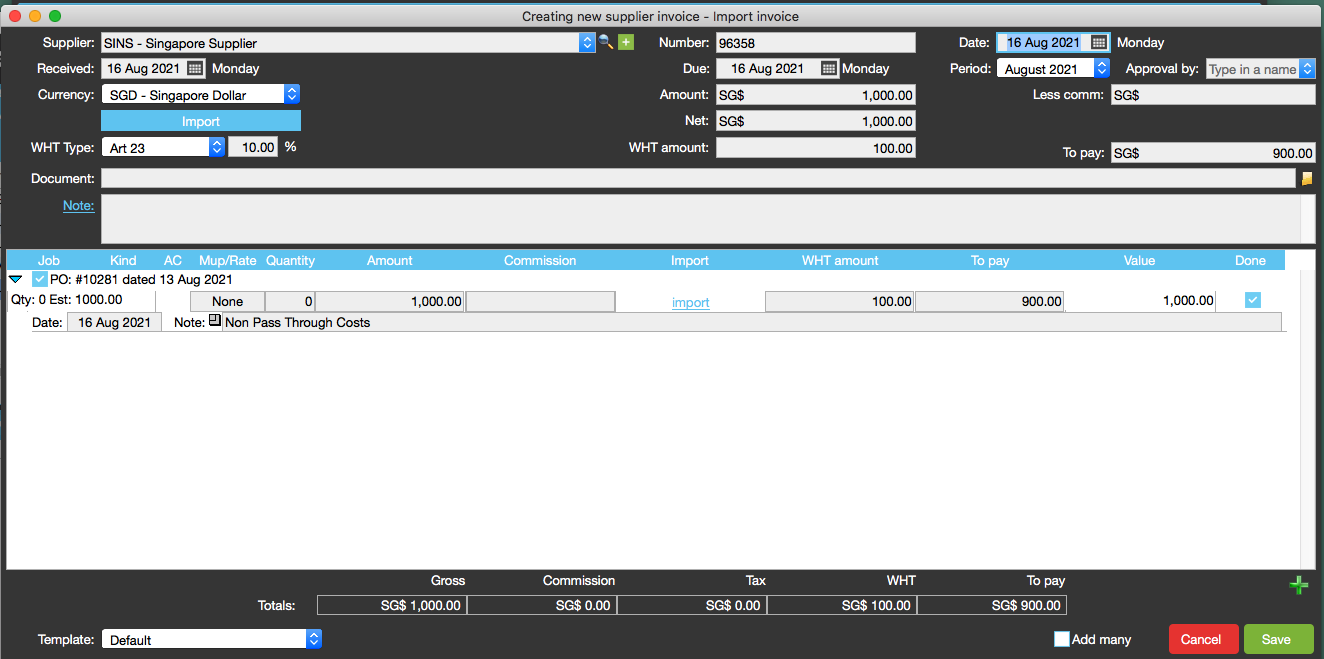

Create Supplier Invoice

In this example, the supplier cost is SGD1000.00, VAT is Nil and WHT is SGD100.00.

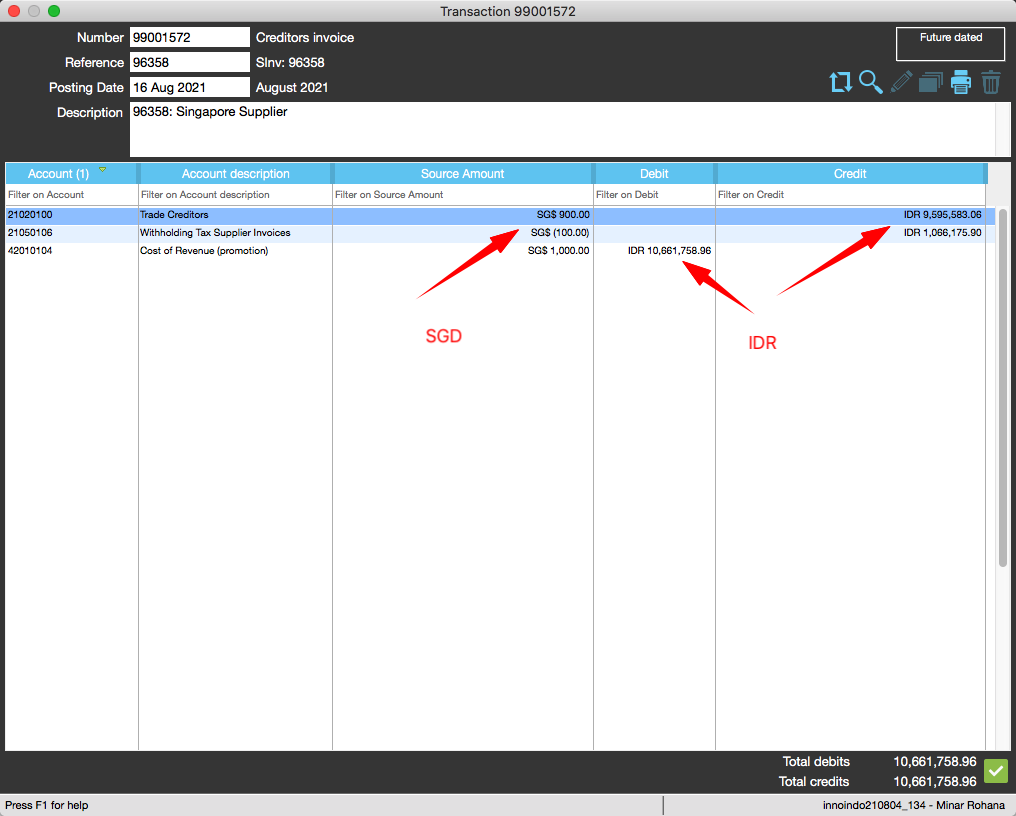

GL Posting

The foreign currency rate is set up in the following screen:

| Note: |

WHT is calculated at 10% of cost on supplier invoice i.e. IDR 1066175.90.

Cost of revenue is IDR 10661758.96

Trade Creditors is IDR 9595583.06

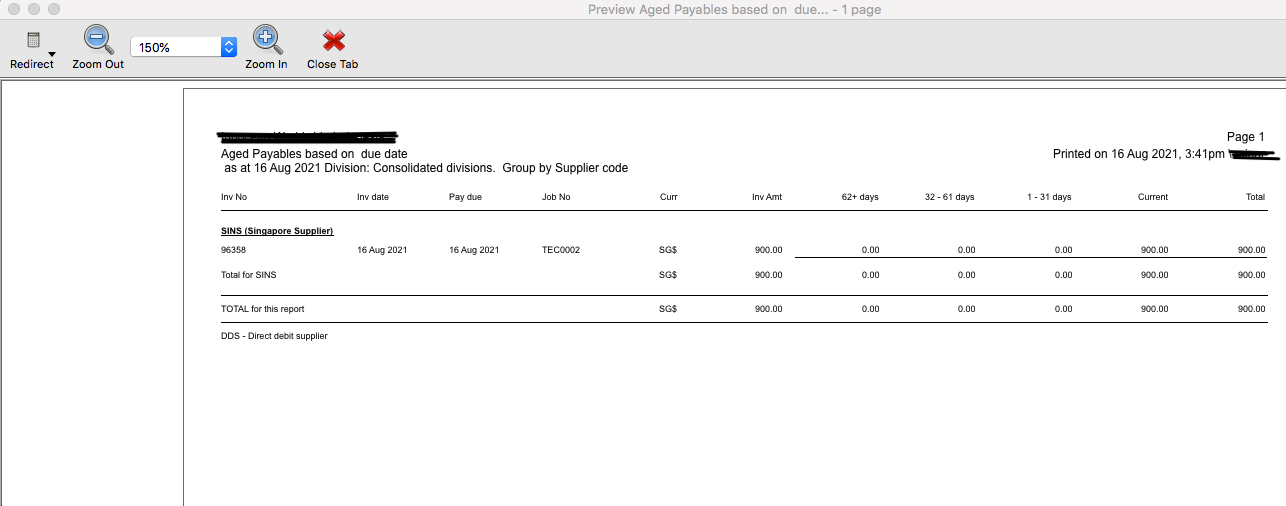

Aged Trade Payables

Aged Trade Payables in currency of invoice i.e. SGD

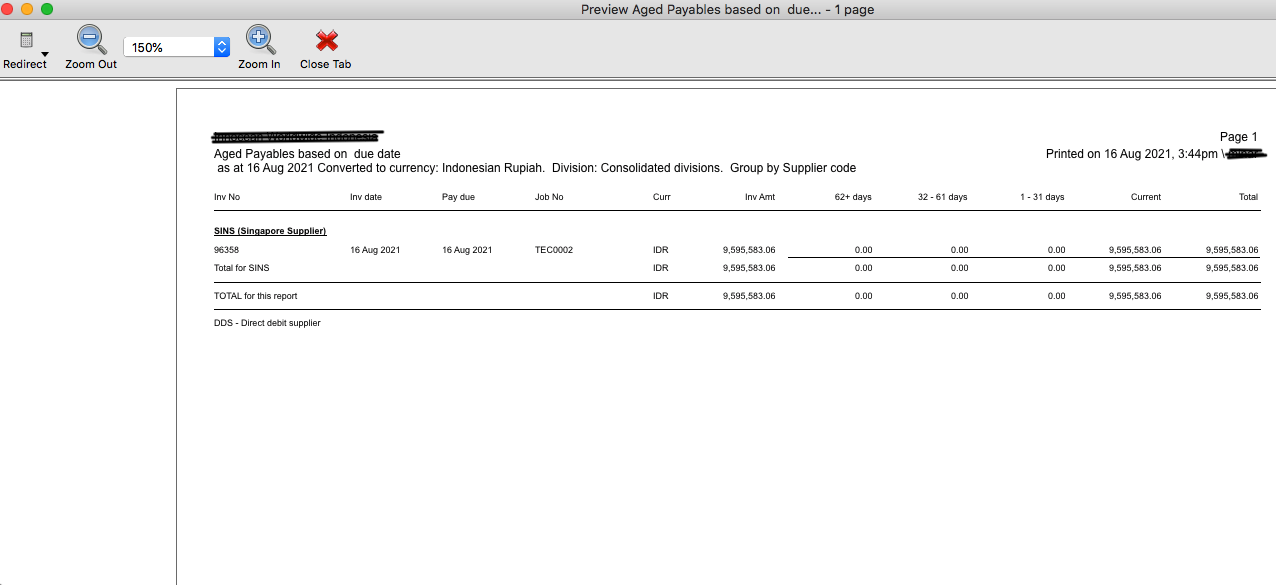

Aged Trade Payables in currency of division i.e. IRD

Organise training or need more help

Please contact support 02 8115 8090 or email support@jobbag.com