- 1 Minute to read

- Print

- DarkLight

Add new Non-Performing Artist to address book

- 1 Minute to read

- Print

- DarkLight

Use this process when you want to add a new Non-performing artist into JobBag

Examples of non-performing talent are hairdressers, make-up artists, sound technicians etc.

Step 1: Add New Non-Performing Artist to Address Book

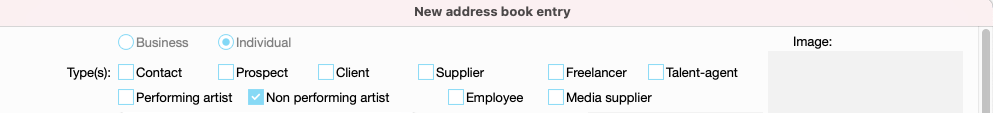

Go to the JobBag Menu > Address book > Select new > Individual > Non Performing Artist

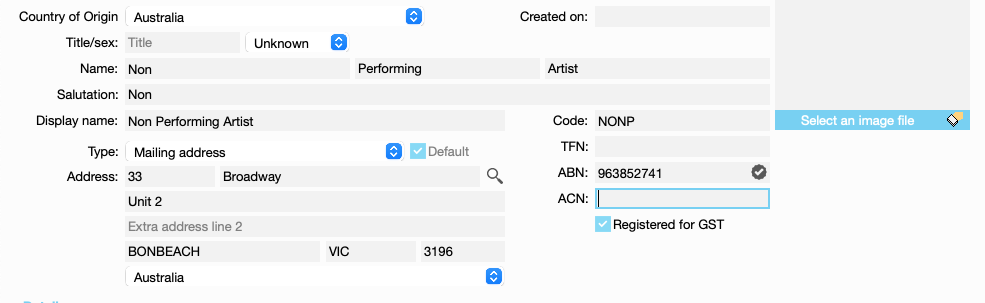

Step 2: Add personal information

Full name, Address, ABN, registered for GST

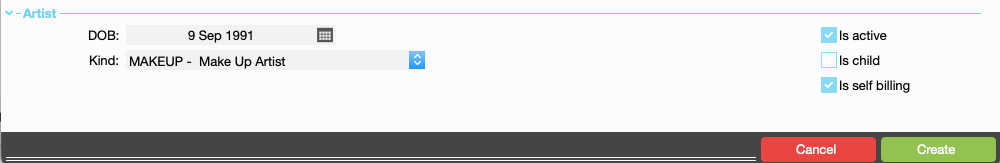

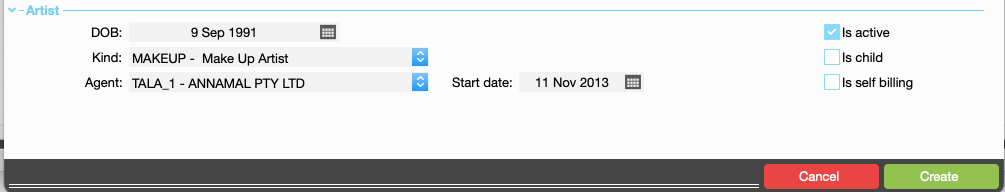

Step 3: Decide Type of Talent

Are they a Sole trader or with an agency?

If they are a sole trader tick “Is self billing”

Add kind

If they are linked to an agent - add agent details, DO NOT tick self billing

Note: The Agent needs to be set up in the address book before you can link the non-performing artist record

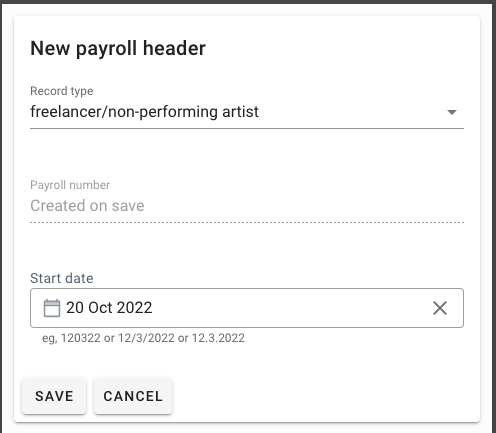

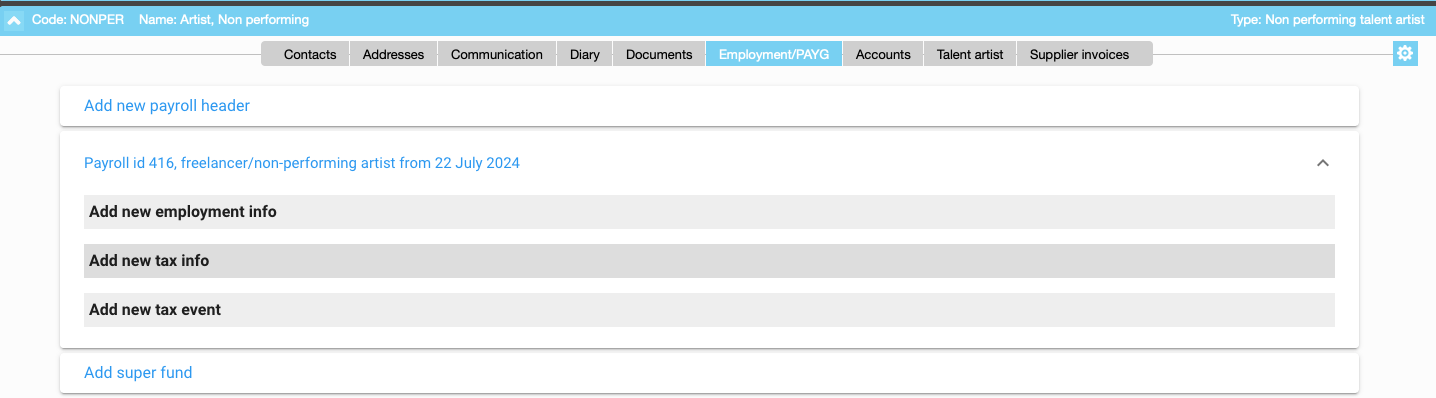

Step 4. Add Payroll Header

This is done in the employment tab > select add new payroll header > Freelancer/non-performing artist > Enter start date

note: If PAYG is to be deducted then this record should be set up under a voluntary agreement

Step 5: Add new tax info

Non Performing Artists do not need to provide a signed Tax Declaration, they just need supply their TFN. This can be done by recording on the Tax Invoice

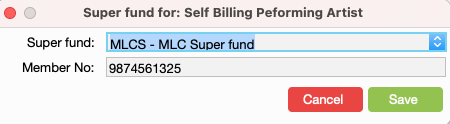

Step 6: Add Super fund

Add the Non Performing Artist's super fund and member number

Need more help?

Please contact support call 02 8115 8090 or email support@jobbag.com