- 1 Minute to read

- Print

- DarkLight

Configure GST and WHT basis

- 1 Minute to read

- Print

- DarkLight

Configure GST and WHT basis and Working Holiday Basis

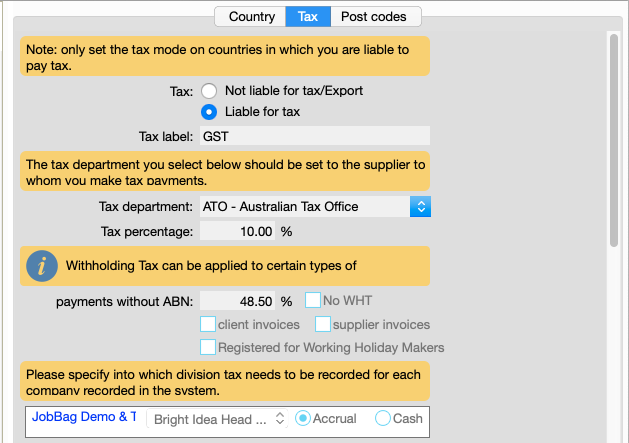

Set up the GST, WHT and Working Holiday Maker rules for the country in this section of the 'Tax' tab,

Complete the following if your company is liable for GST

Field Names | Description |

Tax | Select "liable for tax" |

Tax label | Enter GST for Australia; or VAT for the UK - you can define your unique label |

Tax Department | Select ATO or the tax office in your country from drop down list |

Tax percentage | 10% for Australia; enter percentage relevant for your country |

Payments without ABN | Enter the applicable withholding percentage tax rate |

Select division which records GST | If you have more than one division, select division which records GST |

Client Invoices / Supplier Invoices | Ignore this - this is used for some countries |

Registered for Working Holiday Makers | Tick this if you have working holiday makers on your payroll. If your company is unregistered, there are higher tax implications |

Accrual or Cash | Select GST basis for your company |

Need more help?

Please contact support call 02 8115 8090 or email support@jobbag.com