- 1 Minute to read

- Print

- DarkLight

Working Holiday Maker

- 1 Minute to read

- Print

- DarkLight

See below how to set up a working holiday maker in JobBag

Step 1: Registered/unregistered

When employing a working holiday maker (WHM), Employers need to register with the Australian Taxation Office. Employer registration for working holiday maker

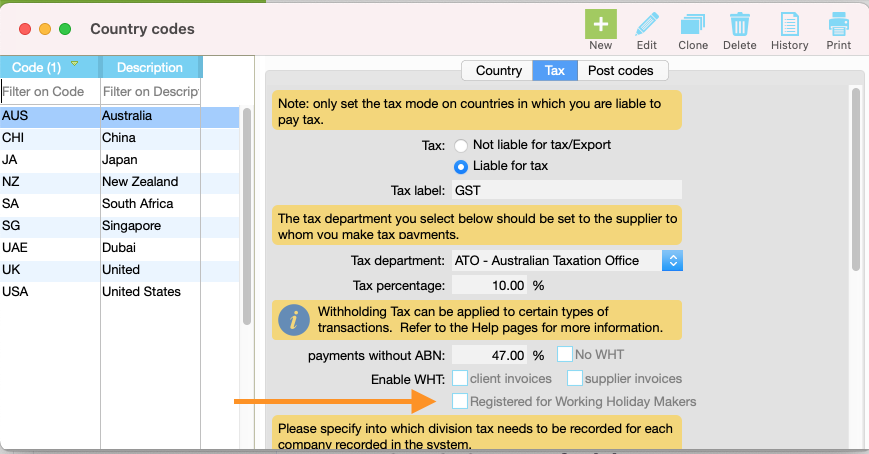

Step 2: Once registered: Tick Registered for working holidays makers in JobBag.

Go to File > configuration > countries > Australia > tax tab

Step 3: Employee’s Country of origin

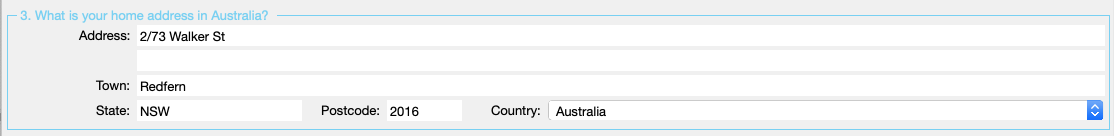

When employing a working holiday maker, their country of origin needs to be reported, this is select in their address book record.

Refer to the help article to create a new Country code

Step 4: Tax Declaration

Question 3. The home address is their home address in Australia

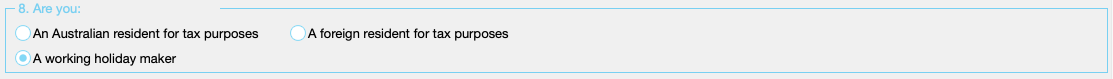

Question 8 Are you "A working holiday maker" should be selected

Need more help?

Please contact support, call 02 8115 8090 or email support@jobbag.com