- 1 Minute to read

- Print

- DarkLight

How to Update YTD and Finalise End of Year with Single Touch Payroll

- 1 Minute to read

- Print

- DarkLight

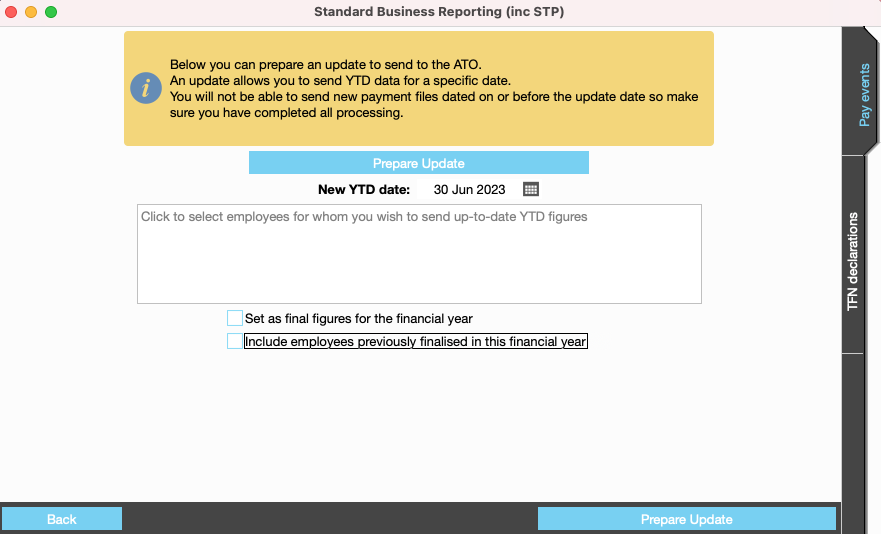

The "New update" action should be used to send Updated YTD data and/or finalise end of year.

In JobBag the new update action allows you to send data to the ATO for employees, talent and freelancers (super only).

Step 1: Prepare New Update file

Navigate to > Payroll > Step 4: Single Touch Payroll (SBR) > New Update

Step 2: Enter New YTD date

Note: This date must be a past date: meaning that the file dated 30th of June must be done on the 1st of July.

Update Action Window explained | |

|---|---|

Field name | Description |

New YTD date | This date must be a past date. Meaning that the file dated 30th of June must be done on the 1st of July. A year end file can be dated prior to 30th June. |

Set as final figures for the financial year | Only tick this to submit your end of year finalisation and declaration to the ATO. End of year finalisation is due by the 14 July each year. |

Include employees previously finalised in this financial year | Only tick if you want to include previously finalised records. |

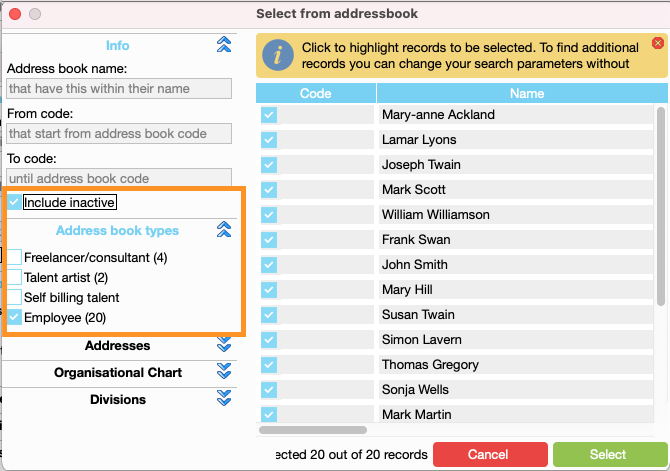

Step 3: Click and select employees, talent and freelancer records

Files can be prepared for a single record or multiple records.

When preparing end of year finalisation, we recommend that you include all records, including inactive.

We also recommend that you send separate files for employees, talent and freelancers.

In the example below we are preparing a file for all employees including inactive you can right click and select all employees.

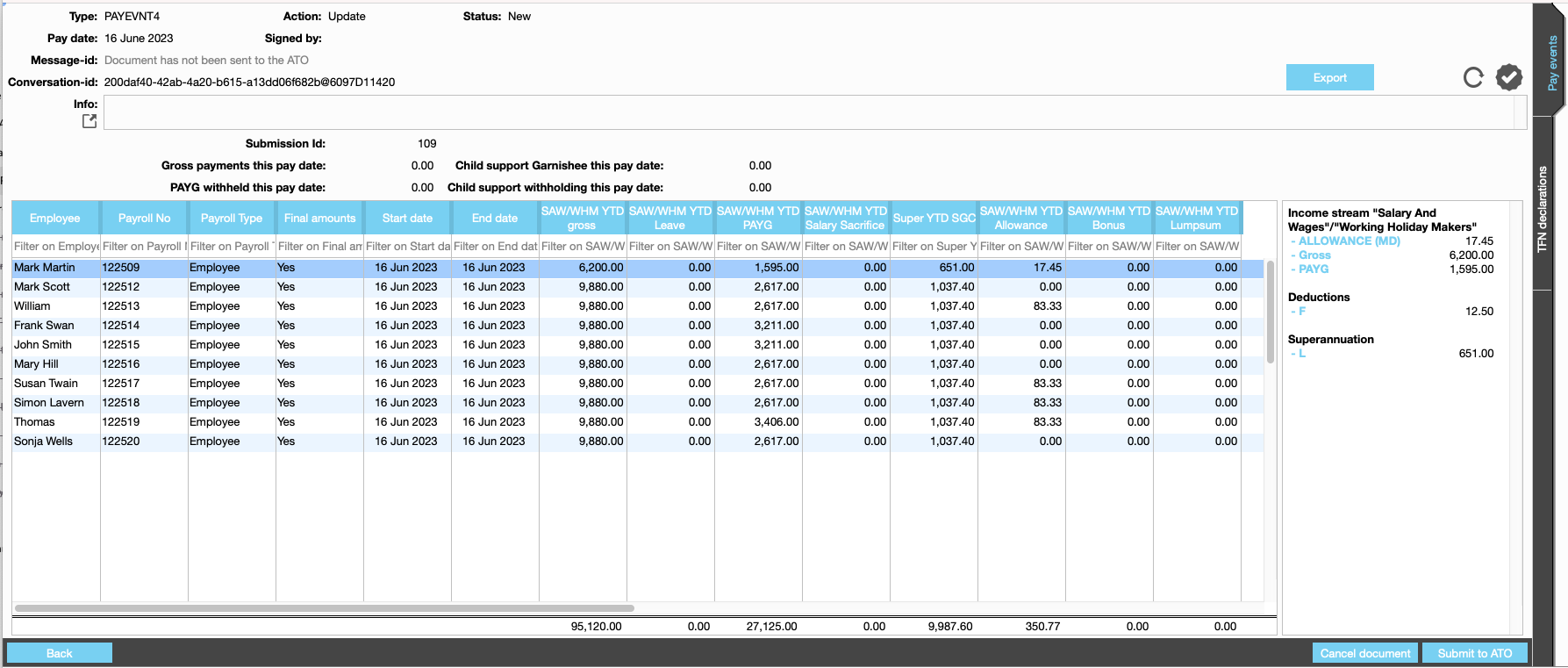

Step 4: Reconcile and Submit to the ATO

We recommend that you reconcile the file to the payslip listing report. The file can also be exported to csv for reconciliation.

Customise your STP window, set up columns and show the information relevant to your payroll:How to Customise the STP Window

New more help?

Please contact support call 02 8115 8090 or email support@jobbag.com