- Latest News

- Getting Started

- Awards

- Accounts

- Active Diary

- Address Book

- Administration

- Clients, Invoicing

- Configuring JobBag (Menu button)

- Dashboard

- Documents

- Finance

- Forecasts and Budgets

- Foreign Currency

- Foreign country withholding tax

- Freelancers & Freelancer agencies

- General Ledger

- GST Reports

- Happy Month End

- JBX Features

- Jobs

- Keywords

- Kinds

- Media

- New Business Development

- Payroll

- Planning

- Productivity

- Purchase Orders

- Request for a Quote

- Rent Income

- Supplier Invoices

- Reports (Menu button)

- Talent

- Timesheets

- Quotes and Estimates

- Trouble Shooting

- WIP and Accruals

- Visual Planner

- JobBag Glossary

- 1 Minute to read

Share this

- Print

- Share

- DarkLight

Staff Deductions from Payslips

- 1 Minute to read

- Print

- Share

- DarkLight

Use this process if you would like to make a staff deduction as an after/post tax amount from an employee's payslip.

In JobBag staff deductions are costs/personal expenses which have been paid on behalf of employees and need to be repaid.

Do not use this process for child support and union fee deductions.

Set up Staff Deductions

Step 1: Set up a GL Account in the Chart of Accounts

Navigate to Ledger menu > Chart of Accounts > new/clone

We recommend setting as a balance sheet account. Use the screenshot as a guide to set up.

Step 2: Create and map After Tax Deductions Kind

Navigate to JobBag menu > Kinds > Payroll category

This kind will be used when posting employee personal expenses from supplier invoices or credit card expenses.

Use the screenshot below as guide to set up the kind.

Step 3: Add item to After Tax Deduction Kind

This item will be used to add to the employee payslip to deduct any personal expenses from employee pay.

Use the screenshot below as guide to check set up.

Step 4: Mapping Staff Deduction Item

Only the staff deduction item needs to be mapped in payroll mapping and SBR Mapping

Payroll > Map payroll kinds > This is mapped to a balance sheet account, you can also map to an expense account.

Note: Do not map to salary and wages

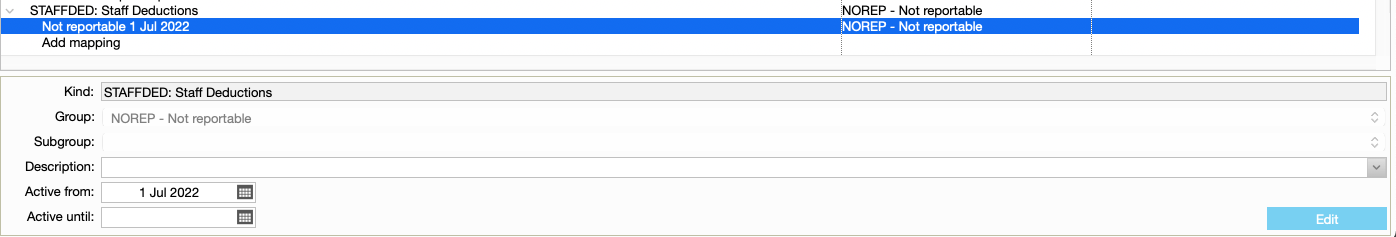

Step 5: SBR Mapping Items

Under Phase 2 of Single touch payroll these type of deductions are not reportable

Payroll > SBR Mapping > This is mapped to NOREP - Not reportable

Processing Staff Deductions

The costs/personal expense paid by the company will be posted to the balance sheet account and the staff deduction amount will be posted to the same balance sheet account and should off-set each other.

Step 1: Recording the costs/personal expense paid by company

The costs/personal expense paid by the company should be coded to the OVER job and AFTERTAXDED kind.

Step 2: Deduct the costs/personal expense paid by the company from the employee payslip

Add in the Staff Deductions item into the payslip and add the amount of the deduction

This is what the payslip should look like after it is saved and approved.

Step 3: Reconcile the After Tax Deduction GL Account created above

This account should net off to Nil at the end of the month

New more help?

Please contact support, call 02 8115 8090 or email support@jobbag.com

What's Next

Table of contents