- 1 Minute to read

- Print

- DarkLight

After Tax Deductions Kind and Items

- 1 Minute to read

- Print

- DarkLight

After Tax Deductions Kinds and Items

After Tax Deductions kinds/items should be used when you would like to deduct an after tax amount from an employee's pay. The most common reason to deduct payments from employee's after tax amounts are relating to staff deductions.

Staff deductions are usually when;

- The company has purchased items on behalf of staff and need to be reimbursed, examples would be paying for tickets to awards/industry nights.

- Staff has used their company credit card for a personal expense and need to reimburse the company.

In JobBag after tax Deductions should be set up as an item, under the After Tax Deduction Kind.

Default

There is already a default kind and item set up and mapped in jobBag for after tax deductions and staff deductions

If you need to set up other after tax deduction items, follow the process below.

Add After Tax Deductions kind to the payroll category

Use the screenshot below as guide and ensure you tick include items

Add Staff Deduction Item

Mapping

You only need to map the items, the item will need to be mapped in both Map payroll kinds and SBR mapping windows

Payroll > Map payroll kinds > This is mapped to a balance sheet account, you can also map to an expense account.

Note: Do not map to salary and wages

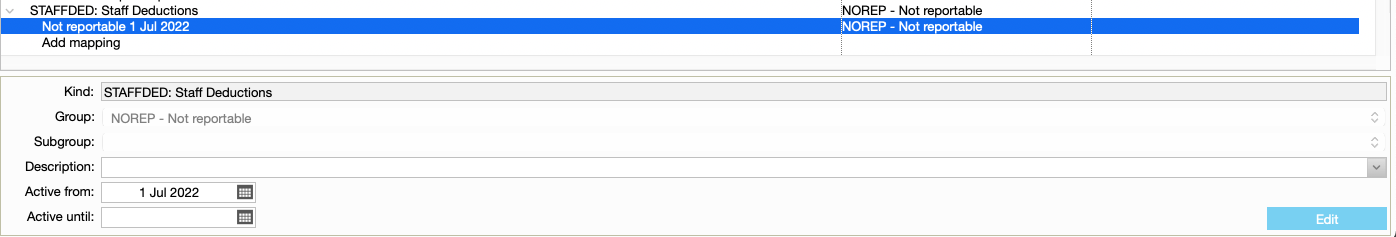

Payroll > SBR Mapping > This is mapped to NOREP - Not reportable