- 1 Minute to read

- Print

- DarkLight

Add a new Performing Artist to the address book

- 1 Minute to read

- Print

- DarkLight

Performing Artists are contracted to perform promotional activity. This includes but not limited to Singing, dancing and acting.

This feature deals with all of the Performing Artist's PAYG withholding, superannuation and reporting obligations as set out by the ATO.

See link to the ATO for further information about Performing Artists

There are three types of performing artist which can be set up in JobBag

- Sole Trader, child or a performing artist linked to an Agent

Step 1: Add a new Performing Artist to the address book

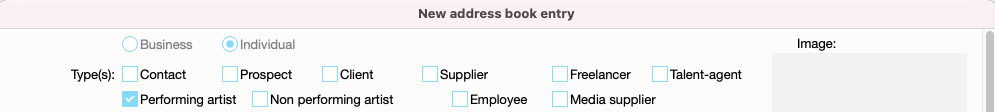

In the JobBag Menu > Address book > Select new > Individual > Performing Artist

Step 2: Add Personal Information

Full name, Address, ABN, Registered for GST

Note: TFN will be added when you complete the Tax Info form

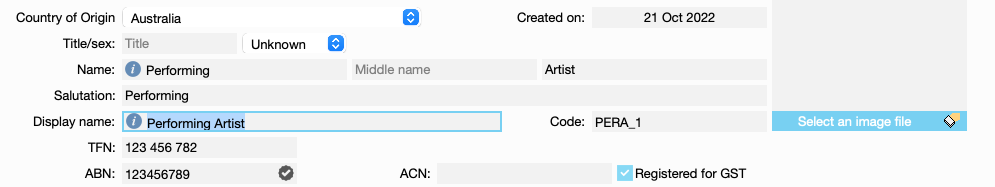

Step 3: Decide Type of Talent

Add date of birth and kind

If they are a sole trader tick “Is self billing”

If they are a child sole trader tick “Is self billing” & “Is child”

If they are linked to an agent - add agent details, DO NOT tick self billing

If the child is linked to an agent - add agent details and tick “Is child”

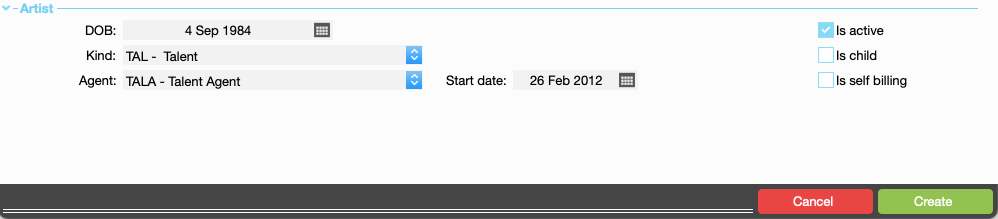

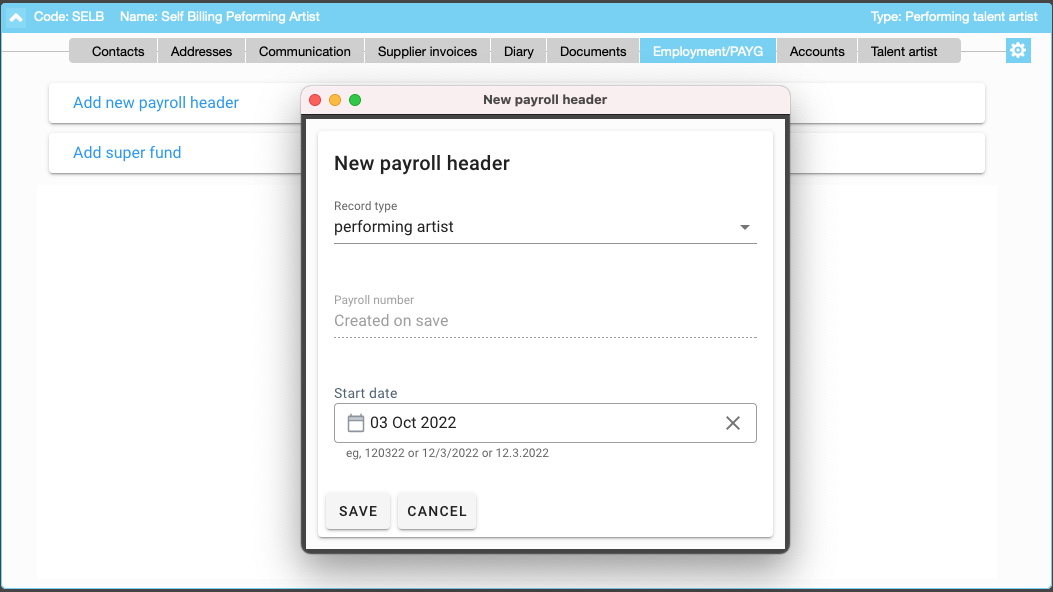

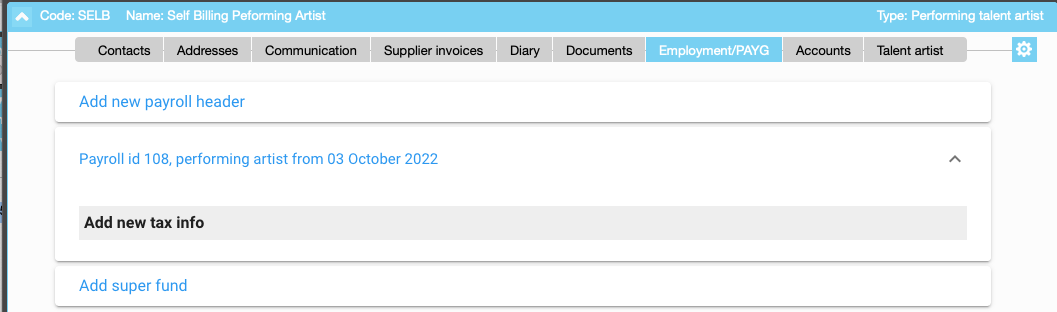

Step 4: Add Payroll Header

This is done in the employment tab > select add new payroll header > Performing Artist > Enter start date

Step 5: Add new tax info

Performing Artist should complete and sign a Tax Declaration OR the Agent should supply a copy.

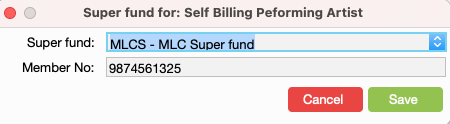

Step 6: Add Super fund

Add the Performing Artist's super fund and member number

Note: The super fund will need to be set up in the address book before it can be added.

Need more help?

Please contact support call 02 8115 8090 or email support@jobbag.com