- 1 Minute to read

- Print

- DarkLight

Maximum Super Contribution Base

- 1 Minute to read

- Print

- DarkLight

Superannuation Guarantee (SG) is capped for employees whose gross earnings is over a certain amount each quarter/year.

The ATO calls this The Maximum Super Contribution Base and sets the maximum contribution base each year.

Use this process if you want to set up the maximum contribution base in JobBag for your employees.

Check out this link to the ATO for information on the maximum contribution base

The maximum contribution base for an individual employee for the 2024/25 financial year is $65,070 per quarter.

Navigate to the employment tab > Add new employment info

This can be set either Monthly or Quarterly

Cap | Description | Example super contribution calculations |

Monthly | Setting the cap to monthly allows you to limit the super to the same amount each month | For example: Based on 2022/23 contribution base and a monthly pay cycle each monthly payslip for the quarter with have equal super contribution amounts of 2107.67 = total for the quarter $6323.01 |

Quarterly | JobBag will calculate the full super contribution on each payslip until the maximum is reached | For example: Based on 2022/23 contribution base and a monthly pay cycle. Each payslip will calculate the full super contribution until the max is reach. First 2 payslips will calculate the full super contribution of $2841.19 and the third payslip will calculate $640.62 = $6323.01 |

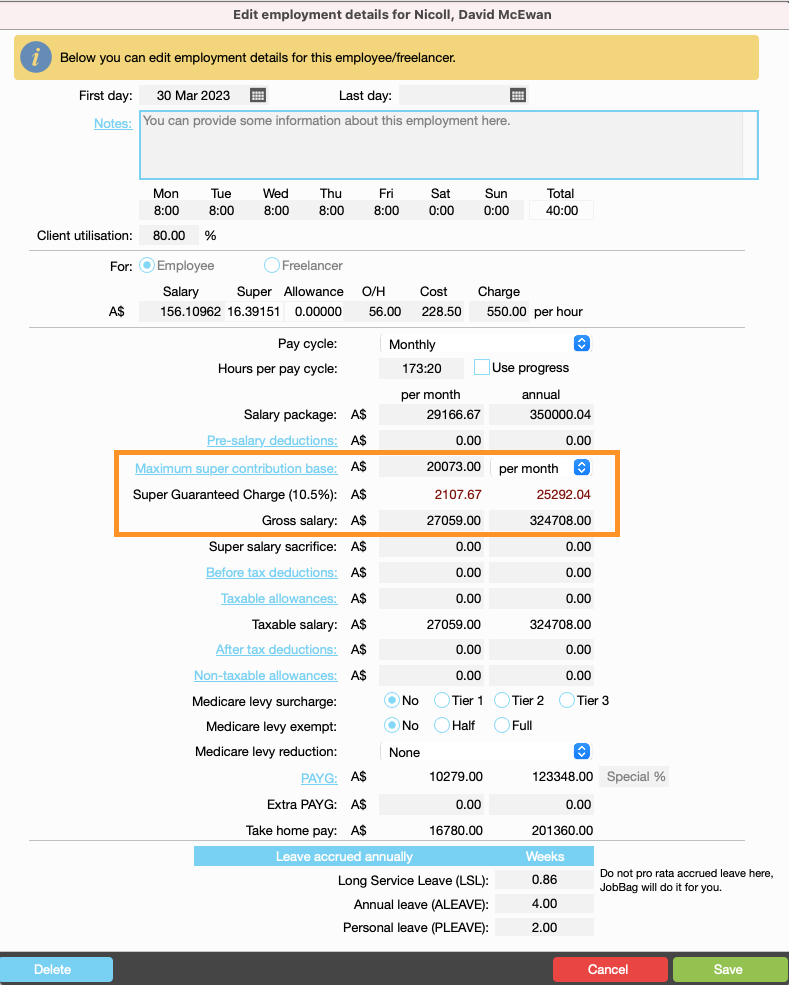

Process 1 - Monthly

Complete the employment details

Enter the Maximum super contribution base for the month. Check the ATO website for this amount

Enter employee's Gross salary if it is a package you will need to deduct the capped super from the package 350,000 - 25,292 = $324,708

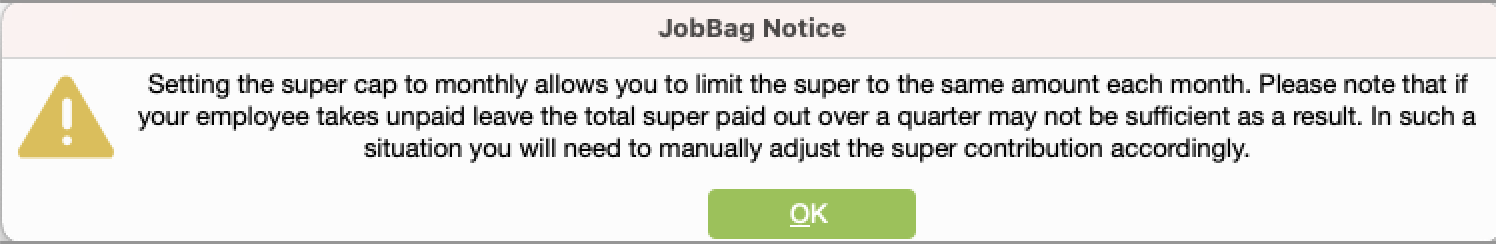

JobBag Notice

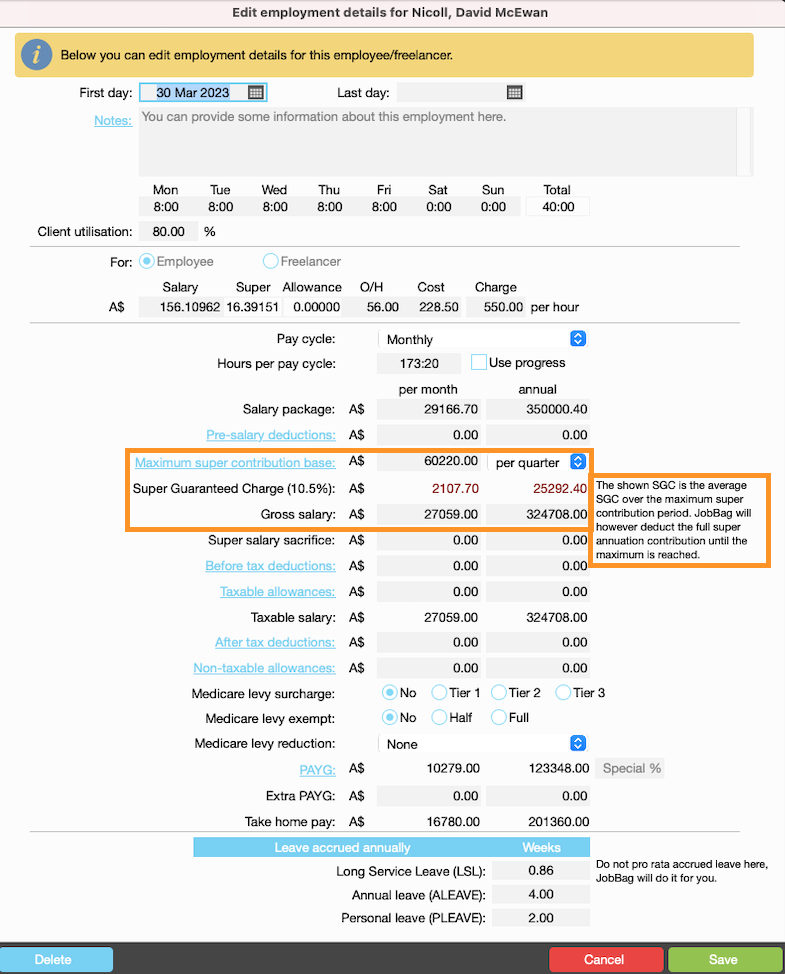

Process 2 - Quarterly

Complete the employment details

Enter the Maximum super contribution base for the month. Check the ATO website for this amount

Enter employees Gross salary if it is a package you will need to deduct the capped super from the package 350,000 - 25,292 = $324,708

Need more help?

Please contact support call 02 8115 8090 or email support@jobbag.com