- 12 Minutes to read

- Print

- DarkLight

WIP & Accruals Process Settings

- 12 Minutes to read

- Print

- DarkLight

WIP & Accrual Process Settings

This is the first step - the settings selected determine how Job Bog will value your WIP and process the month-end accounting entries.

The WIP Settings are accessed through Ledger/ WIP Settings

WIP Settings and Check Box Decisions

Select the “WIP setting” options that reflect the way your business works and how you wish to match costs and revenue.

- Example 1: You have incurred costs but have not invoiced your client - the WIP & Accrual process calculates the amount of WIP value you may wish to move out of the P&L and into the Balance Sheet as an asset; this entry for external costs is automatically reversed out the next month.

Example 2:You are able to invoice a client in advance before a job commences. In this case, the WIP & Accrual process calculates the amount you may wish to move out of revenue and into the Balance sheet as a liability “Pre Billings”.

Note: Settings can be selected in JobBag to keep track of external costs as well as internal time costs on a job. |

Other Terminology

- Implied costs: the calculated external cost of something you have invoiced to a client. e.g. you have invoiced a client $1500 for an external kind like Printing but you have not raised the Purchase Order yet. The kind for printing has a markup of 25%. Therefore the implied cost of the $1500 invoiced to the client is 1500/1.25 = 1200.

In-house costs: the cost on each timesheet entry and item charge. If there are no-cost rates set in employees and Kinds, there will not be a cost on these entries.

External costs: a cost from a supplier entered as a supplier invoice or a Don’t credit payment.

In house WIP & Accrued Revenue: If you have ticked that you want to account for this time as an asset, then the system allows you to make a decision on all unbilled time and either recognise the cost as WIP or accrue the value of the time as Accrued Revenue.

External WIP, Accruals and Pre-billings: In here are three scenarios that the system looks after:

1 Pre-billings: If your process is that you bill your client 50% up front as a deposit or your client has asked you to bill them early as they have some budget left over that they don’t want to lose, but you haven’t yet done the work, you shouldn’t have all that income as earned in the period. The WIP process allows you to transfer some or all of that income into a future period, and keep doing that till the job is complete. So if you have billed say $50,000 but have only doe $10,000 worth of work, use WIP income to move $40,000 to a future period.

2 Accruals: If you have invoiced a client for some printing, but you haven’t yet seen the invoice from the supplier, you don’t want to overstate your profit in the period of the invoice and then take a big loss when the supplier's invoice comes in. Assuming that you send PO’s to your suppliers when you do WIP and accruals, the system will default to accrue any open PO dated prior to the month-end so that it will automatically bring that cost to account, and then reverse it the next month. You have the opportunity to override that number as you may not have invoiced the client yet for that printing. The trick here is not to date PO’s after the fact – if you do an invoice on June 30 and a PO to the supplier dated July 1, the WIP & Accrual for June won’t necessarily try and accrue the PO as it is evaluating the values as at 30 June 2014.

3 WIP costs: This is the reverse of the above: you may have incurred some costs that you will eventually charge to the client, but not this month. Here the system takes those costs out of the P&L and puts them in the Balance Sheet, ready to be used in a future period so that you won't take a hit on your costs till you are able to match it with an invoice to the Client.

Automatic Calculations

Automatically write off WIP on these job types:

The first decision is to check off the job types that will never hold any WIP Value in your business. These might be in house projects, New Business type jobs or pitches, Client Forecast. Whatever job types are selected, they will be excluded from the WIP processing list and will not bring any value into the GL.

Automatic Calculations - Limit accrual calculations to kinds that have been billed.

If the system sees an un-invoiced PO for a kind, it will accrue that cost. However, if this box is ticked and the kind has not yet been invoiced - there will be no accrual.

Note: Points to note here though, is that you need to be careful that you are going to invoice the Client using the same kind consistently. So if you have invoiced the Client for some printing using a kind called PRT, but sent an order to the printer using a kind called PRTG, then JobBag doesn’t know that the two are one and the same |

Automatic Calculations - Automatically accrue implied costs on external kinds

JobBag used to work so that it would only accrue if there was a PO in place, and that that PO was dated in the current period. If the PO was dated after the month-end, then it would not automatically accrue the cost. Now the system looks at the estimate and if the estimate “implies” a cost, even though there is no PO nor a supplier invoice in the system yet, it will accrue that cost if this box is ticked.

However, please note implied costs are accrued only when the pre bill option “Pre-billings -calculated manually” is selected. |

Automatic Calculations - Ignore jobs with the status “Proposed”.

This is similar to the first calculation. If you tick this box, it will not hold any value as WIP on these jobs.

Automatic Calculations - Set values Proportionally / FIFO.

This is an either-or decision.

If you are writing off or writing on Value at month-end, JobBag needs to put that action to an individual transaction. So let's assume that you are “writing off” $300 of in-house WIP (Timesheet Value $10,300, Invoice or WIP that you want to carry =$10,000) over a series of timesheet entries for the kind. If you tick Proportionately, then JobBag will apportion the write off of $300 over all the timesheets that make up the $10,300. If you tick FIFO, then the last timesheet entries will carry the write-off. The same principle will apply if written on.

Automatic Calculations - WIP level

Select one of the following options:

This is an either-or selection. This determines the level at which the WIP and Accrual process calculates WIP. The recommended setting is “phase/category”. When “confirming” the jobs during the WIP and Accruals process it is possible to review selected jobs at a more detailed level.

Income recognition model

Different companies have different rules as to when and how income (and Pre- billings) is recognised in their accounts, and this selection process reflects this. Select one of the following options - it is an either-or decision.

Income Recognition - Pre- billings are calculated manually

If this is chosen, then the default in the WIP Billings column will be empty, and it will be up to you to define on a job by job level (this is the traditional method). This option applies to “All jobs” - there are no other options.

Income Recognition when the job is dead

Some companies operate this way. They do not recognise invoiced income on a job until the job is completed and dead. This WIP setting allows income to be recognised as pre-billed until the job is dead.

When the client invoice is logged, the GL transaction is :

DR: Trade Debtors

CR: Relevant P&L Income Account

When WIP and Accruals is run, the transaction is:

DR: Relevant P&L Income Account

CR: WIP Pre-Billings Account

At this point, the value in the Income statement is Zero for the billings and similarly, any costs incurred to date are moved to WIP. The above GL transactions remain until the job is marked as dead. It only goes to the final GL posting accounts when the project is marked dead.

Note: There is a further selection option. Do you want this income recognition to apply to:

1 All jobs? or

2 Most jobs? or

3 Some jobs?

If either option (2) or (3) is chosen, when you open a new job, the tickbox “income recognition enabled” is ticked as active. Otherwise, it is turned off by default, but can be activated.

Income recognition: Invoiced - Value (to date)

If this selection is made, the default WIP column will determine the WIP billings based on this calculation. So if you have invoiced $50,000 on a project but the value of the work done to date is only $30,000, then WIP Billings is $20,000. This operates at a line item (or kind) level, if a kind is over billed, then WIP billings come into play, but if underbilled, then the assumption is that there is still WIP value on the job and that will be carried forward.

Note: There is a further selection option. Do you want this income recognition to apply to:

1 All jobs? or

2 Most jobs? or

3 Some jobs?

If either option (2) or (3) is chosen, when you open a new job, the tickbox “income recognition enabled” is ticked as active. Otherwise, it is turned off by default, but can be activated.

External costs

Select one of these options:

Do not write External WIP to the General Ledger

This option is not available. (Note: if this option is selected, that means any supplier costs on outstanding PO’s will not be accrued as a default).

Write External WIP costs to the General Ledger

This is the default option and if chosen, the costs from un-invoiced PO’s will be accrued (This interrelates with option 2 in Automatic calculations above - if Option 2 in Automatic Calculations is ticked then default accrual happens only if the line item is billed).

Write External WIP Value to the General Ledger as Accrued Revenue

Selecting this method means that any external value not billed on a job will be written to the General Ledger as Unbilled Value. For example, if a Supplier Invoice came in at Cost = $1000, with a 35% mark-up, recognizing the unbilled value would be $1350. So we have Invoiced = $0, External Costs $1000, Unbilled Value $1350. Entry is:

DR WIP (balance sheet) $1350

CR Unbilled Value (P&L) $1350

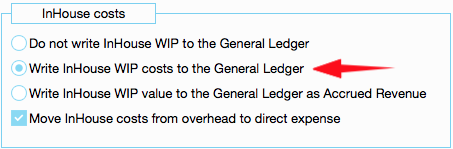

InHouse Costs

Move InHouse Costs from Overhead to direct expense

This section allows you to account for and value in-house activities such as timesheets

1. Move InHouse costs from overhead to direct expense

'Move InHouse costs from Overhead to direct expense' can be selected with either:

- 'Write InHouse WIP costs to the General Ledger' or

'Write InHouse WIP value to the General Ledger as Accrued Revenue'

In this case, the cost of the InHouse time is moved from salaries & wages overhead to the Direct Costs account above the line. NB: All these values will post to the GL at a kind level. This is done in the GL Mapping on the kind screen and the mapping on the Control Accounts - see screenshots below.

In the Chart of Accounts (Ledger / Chart of Accounts) the following additional accounts need to be created and mapped to Control Accounts.

The additional GL accounts are for:

Work In Progress Inhouse Costs

External unbilled Value

Inhouse Unbilled Value

P&L Account for crediting the overhead salary costs which are transferred to job costs

The above accounts are then mapped as control accounts:

For each kIND code, additional mapping needs to be in place:

In the employee window include a cost rate for an employee

When all of the above is completed, JobBag automatically creates the following entry for the total chargeable time when the WIP and Accruals page is open:

DR: the account for the mapped kind for that time. (above the line in Gross Profit)

CR: The staffing cost for the total chargeable time (below the line)

Do not write InHouse WIP to the General Ledger

This is the traditional approach - un-billed InHouse time (i.e. usually salaries)is written off to the P&L each month. However, if you have a “lumpy” billing stream where one month has huge billings and the next month nothing, then there are now two additional options to help smooth out that peaks and troughs.

Write InHouse WIP costs to the General Ledger

Plus select option 'Move InHouse costs from overhead to expense |

This is the more conservative approach where you have unbilled In-House time on a project that you want to recognise. Choosing this option allows you to recognise the cost of unbilled time in the Balance Sheet during the month it was incurred - eg if timesheet costs of $1000 have been incurred on a job, the unbilled timesheet costs are moved from the salaries expense to direct costs and from direct costs to WIP in the Balance Sheet.

The accounting entries are:

Debit: WIP (Balance Sheet)

Credit: Direct Costs (P&L)

Write InHouse WIP value to the General Ledger as accrued Revenue

This option recognises the value of in-house work as revenue in the month it was completed.

Plus select option 'Move InHouse costs from overhead to expense |

Choosing this option allows you to recognise the full value of the unbilled time as the default. So if timesheet costs of $1000 have generated $2500 of value, the value of the time is recognized as Revenue. The Accounting entry is:

Dr Unbilled Value Account (Asset Account in Balance Sheet)

Cr Accrued Revenue Account )in P&L)

General Settings

Enable WIP as you go

If this is ticked, every time you log an invoice, you will be presented with a screen asking you to calculate the WIP and or Accrual at that time, rather than waiting till the end of the month. It will still show at the month-end report, but it is allowing the user to make the calculation while they are on the job and making decisions around it. It also reduces the end of month workload, but remember that subsequent transactions such as timesheets will affect the outcome.

Number of jobs to see in each tab

If you have a large number of jobs, JobBag breaks down the list into a number of tabs, so that you can work on them a section at a time. When set, this number is the number of jobs that will default as the number per tab.