- 1 Minute to read

- Print

- DarkLight

How to set up Foreign Countries in JobBag

- 1 Minute to read

- Print

- DarkLight

Use this process if you want to set up Foreign Countries in JobBag

You need to set up the countries for any Foreign clients and suppliers and/or if you want to use the multi currency feature

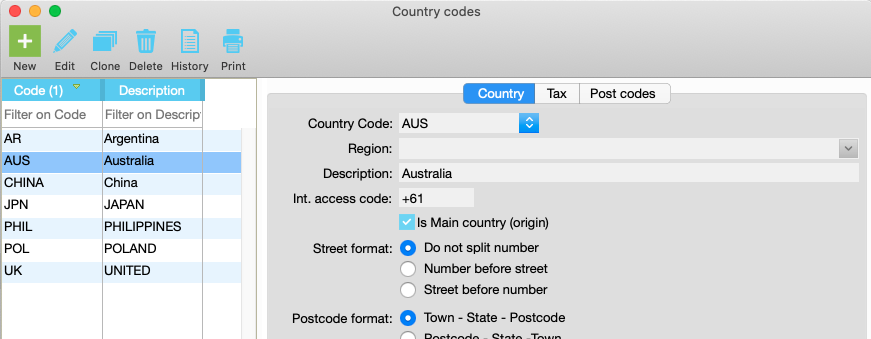

Navigate to: File menu > Configuration > Countries > New

The three tabs where the following information configured for each each county:

Country tab

Learn how to configure Countries here →

Select a country code from the drop down list. Eg., The country code for Australia must be AUS - the code provided in the drop down list.

We recommend using the (optional) address lookup service. This helps you fill in the right information in the Address fields.

Input the default Currency for that Country.

Option to use Australian Business Register service.

Customise the TFN, ABN, ACN labels.

Tax tab

Only set the tax mode on countries in which you are liable to pay tax.

For your employees, suppliers, freelancers and talent, the Countries must be set up correctly so that payments and tax requirements flow through correctly.

Configure Tax rules for each Country here →

Configure GST and Withholding Tax →

Select options for GST. Select Tax department and enter rates, if applicable.

Decide on withholding tax rates for supplier and client invoices.

Specify division on which tax needs to be recorded and basis for GST.

Set up tax basis for PAYG and Talent →

Decide on tax basis for Talent.

Configure superannuation rates for payroll →

Update superannuation rates for period starting on 1 July 2023. Note the rates for the year starting on 1 July 2022 has been created by JobBag.

Workers compensation rates.

Payroll tax rates.

Decide on child age for processing Talent.

Decide on the talent payment basis eg weekly or fortnightly or monthly.

Leave accrual default basis for employees.

Need more help?

Please contact support call 02 8115 8090 or email support@jobbag.com