- 1 Minute to read

- Print

- DarkLight

How to Process Paid Parental Leave (PPL)

- 1 Minute to read

- Print

- DarkLight

Use this process if you are required to set up and pay Paid Parental Leave scheme for an employee

Before you start you should have received a Payability Determination from Services Australia

PPL Set Up Process

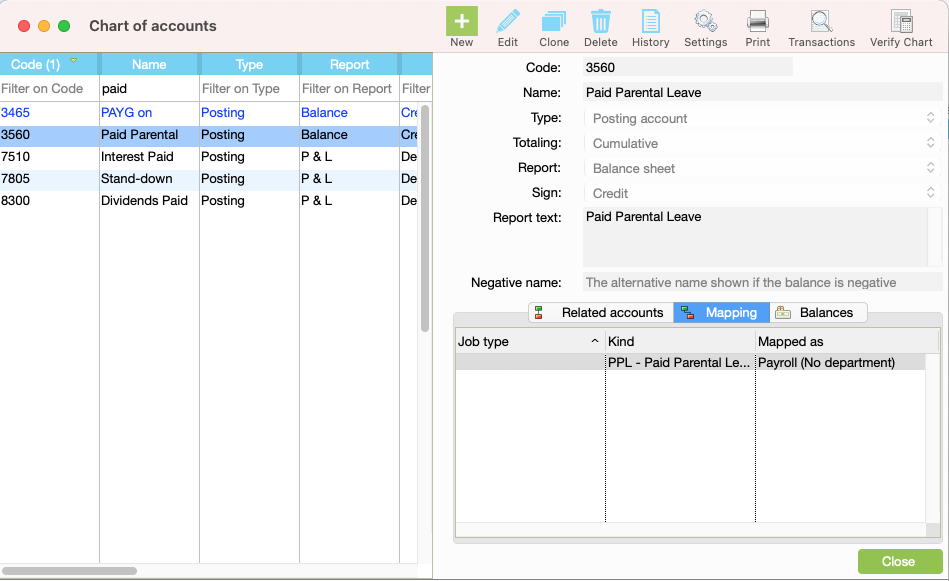

Step 1 Create a new current liability general ledger account

Navigate to Ledger > Chart of accounts

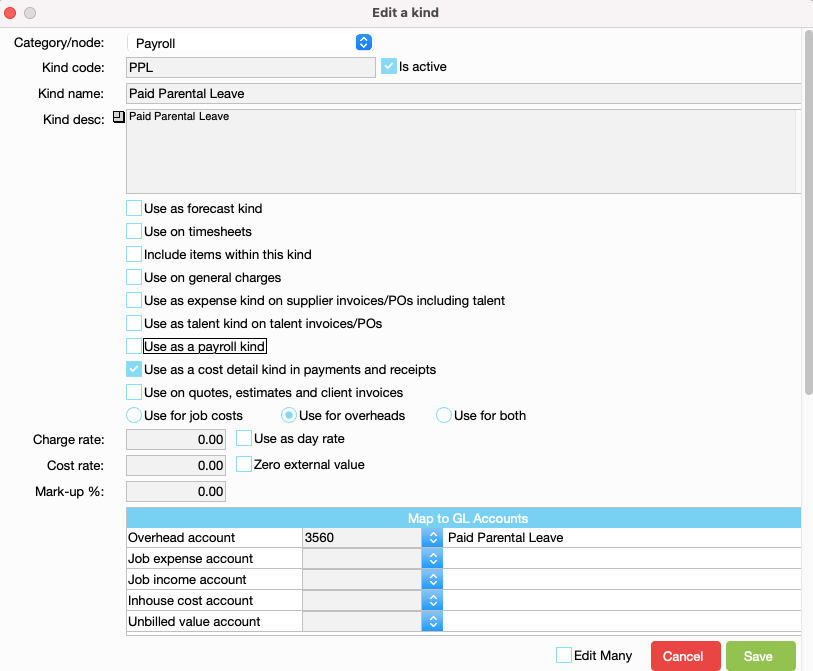

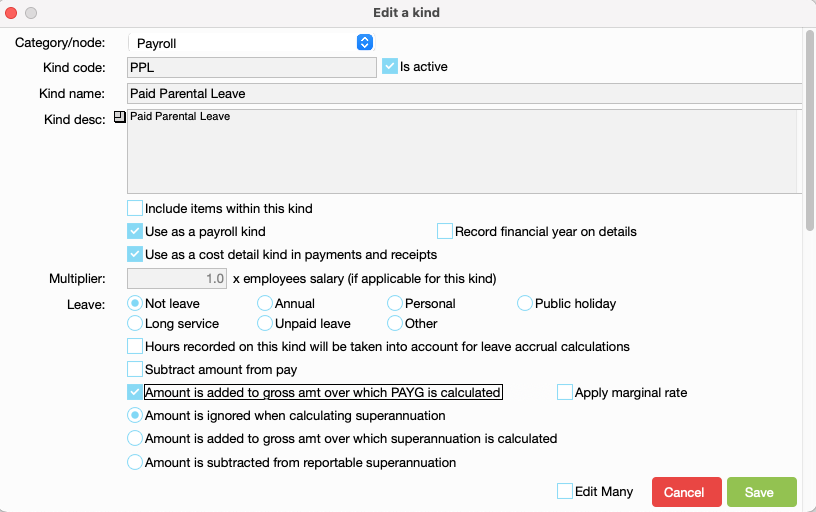

Step 2 Create Payroll Kind

- Map Overhead account to the Paid Parental Leave account set up above

- Tick Use as a cost detail kind in payments and receipts

- Tick Use as a payroll kind

- Ensure the kind is set up as per screenshot

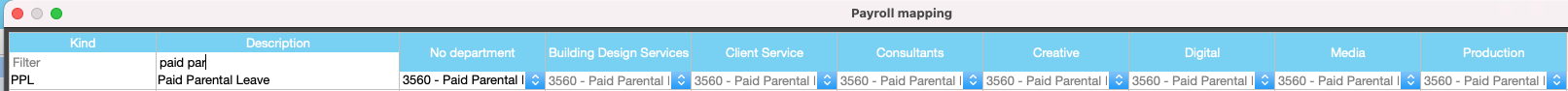

Step 3 Map kind to the GL accounts

Navigate to Payroll > Map payroll kinds

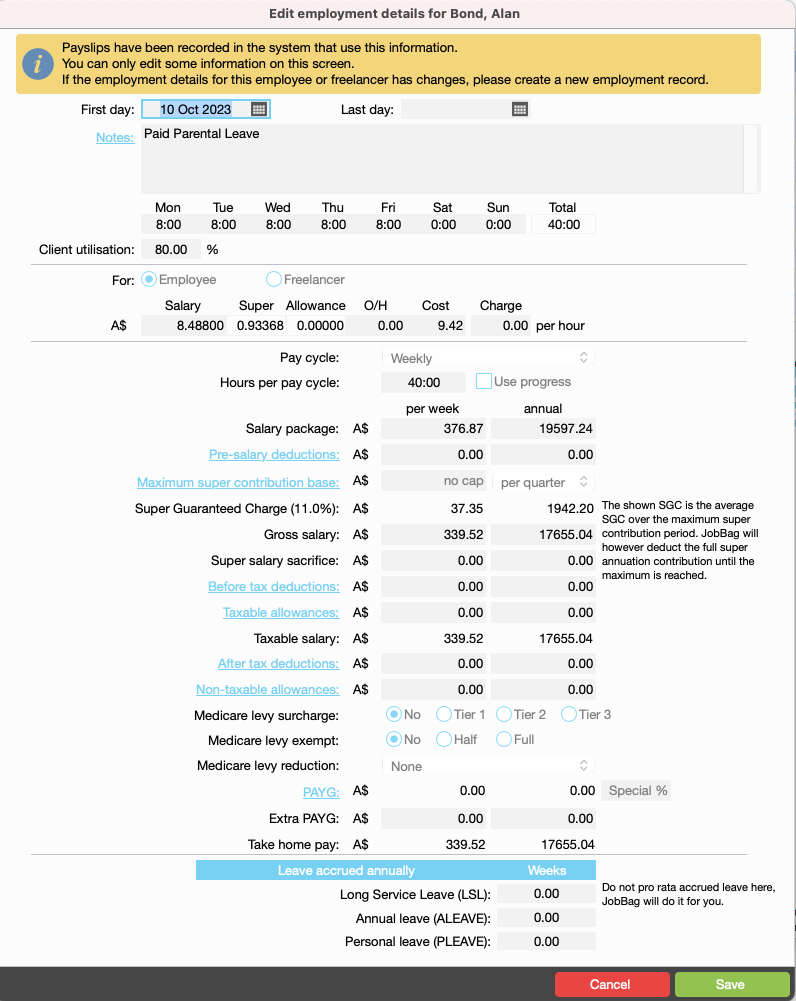

Step 4 Add new employment info

Navigate to JobBag > Addressbook > employee

PPL Payment Process

Do not make the payment to your employee until you have received the funds from Services Australia.

When funds have been received from Services Australia use the below process.

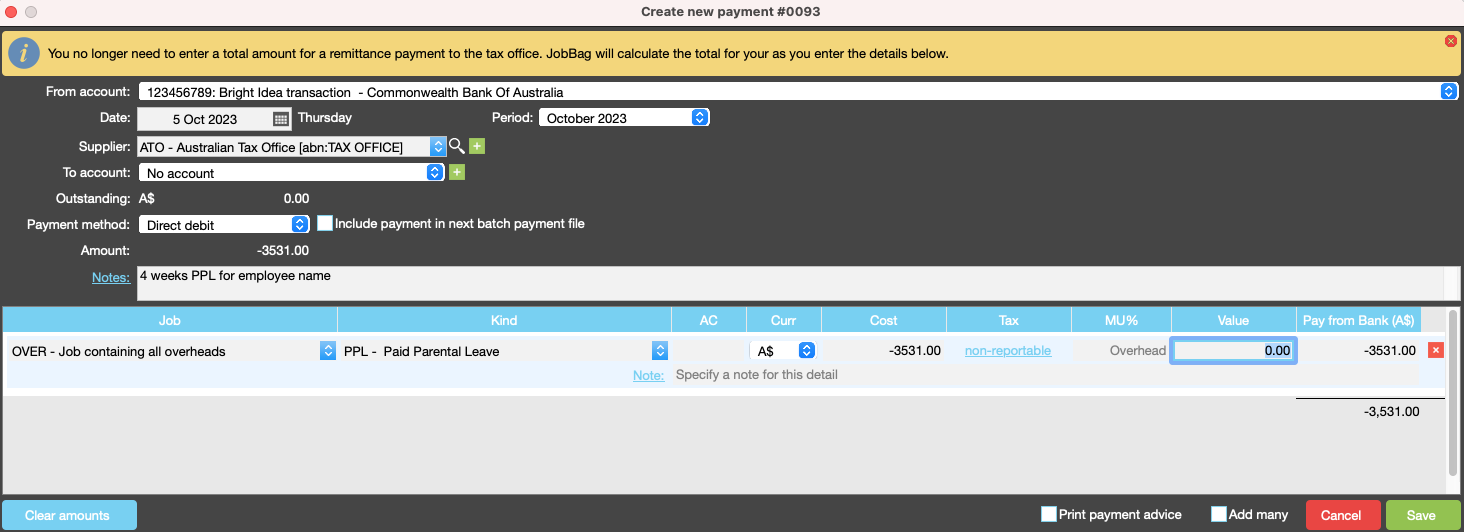

Step 1 Process receipt from Services Australia as a negative payment

Navigate to Accounts > Payments

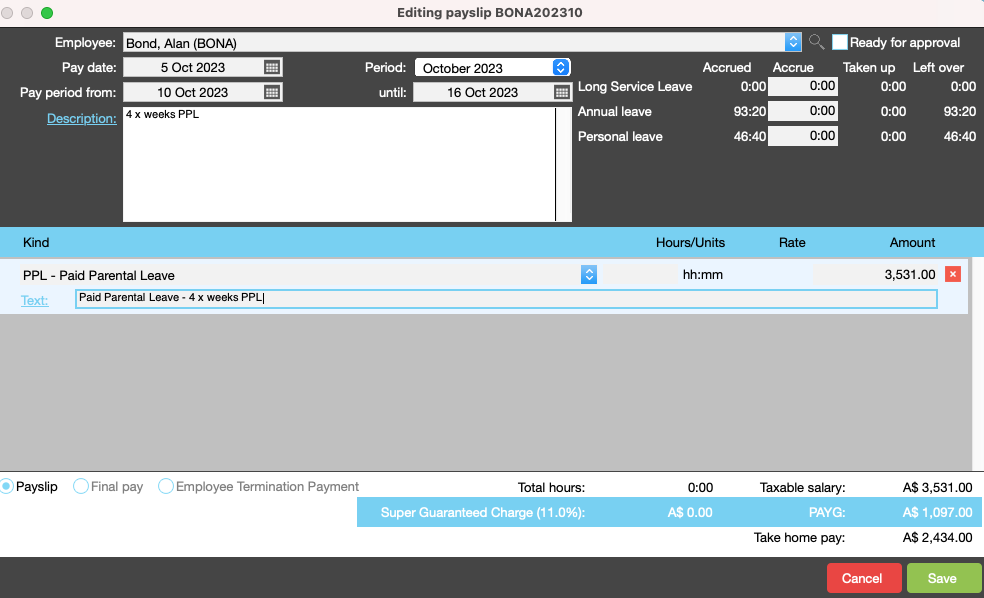

Step 2 Create a manual payslip

Navigate to Payroll > Step 2: Manual payslips

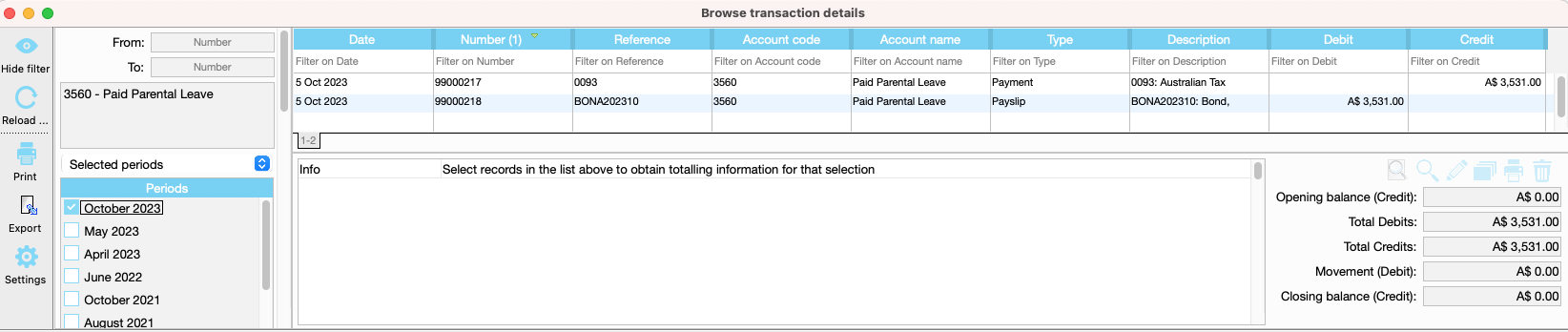

Step 3 Reconcile Paid parental leave GL account

Navigate to Ledger > Transactions

This account should be nil

Need more help?

Please contact support call 02 8115 8090 or email support@jobbag.com