- 1 Minute to read

- Print

- DarkLight

Add Employment/Salary Information

- 1 Minute to read

- Print

- DarkLight

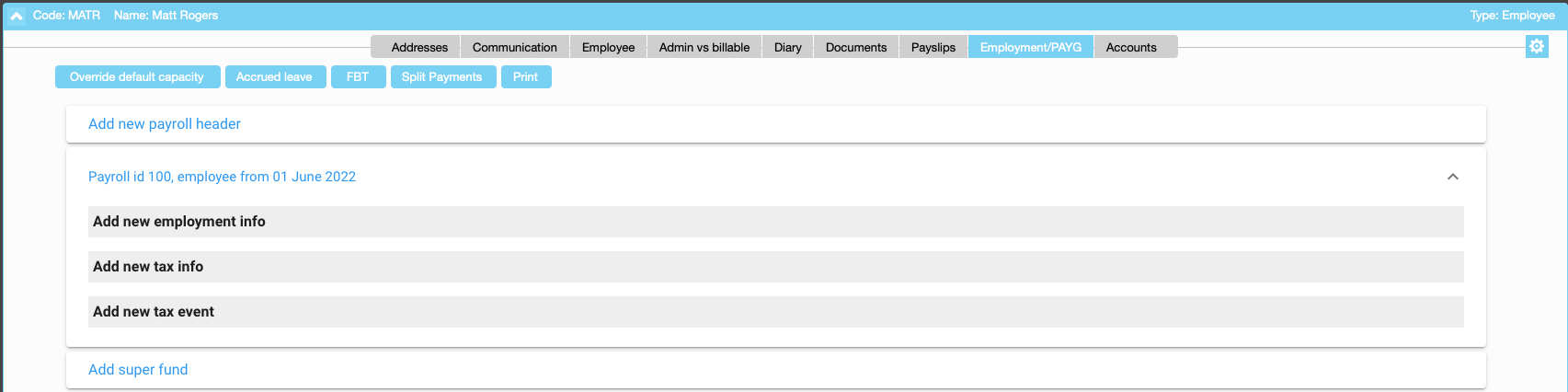

The employment tab in the employee's address book record allows you to enter all the employment information such as salary, tax declaration, leave entitlements, superannuation funds, charge out and utilisation rates. There are four main areas to be completed. The payroll header, employment information tax info and the superannuation fund details

Payroll Header

When you take on an employee, freelancer, performing artist, non-performing artist, working holiday maker or enter into a Voluntary Agreement with someone, you will need to set up a Payroll Header for them. This payroll header will be unique for that person and the business relationship with them.

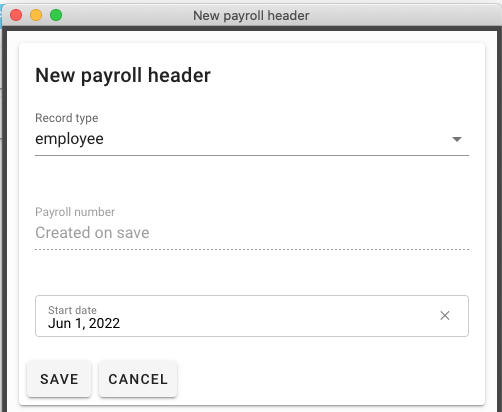

Select Add new payroll header > Select Record Type > start date and save

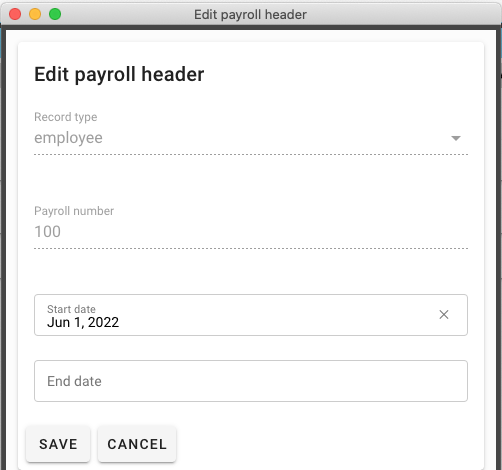

Saving will create the unique payroll number > save again

Save again; you then need to enter Employment info, tax info and superannuation fund details

Add new Employment Info

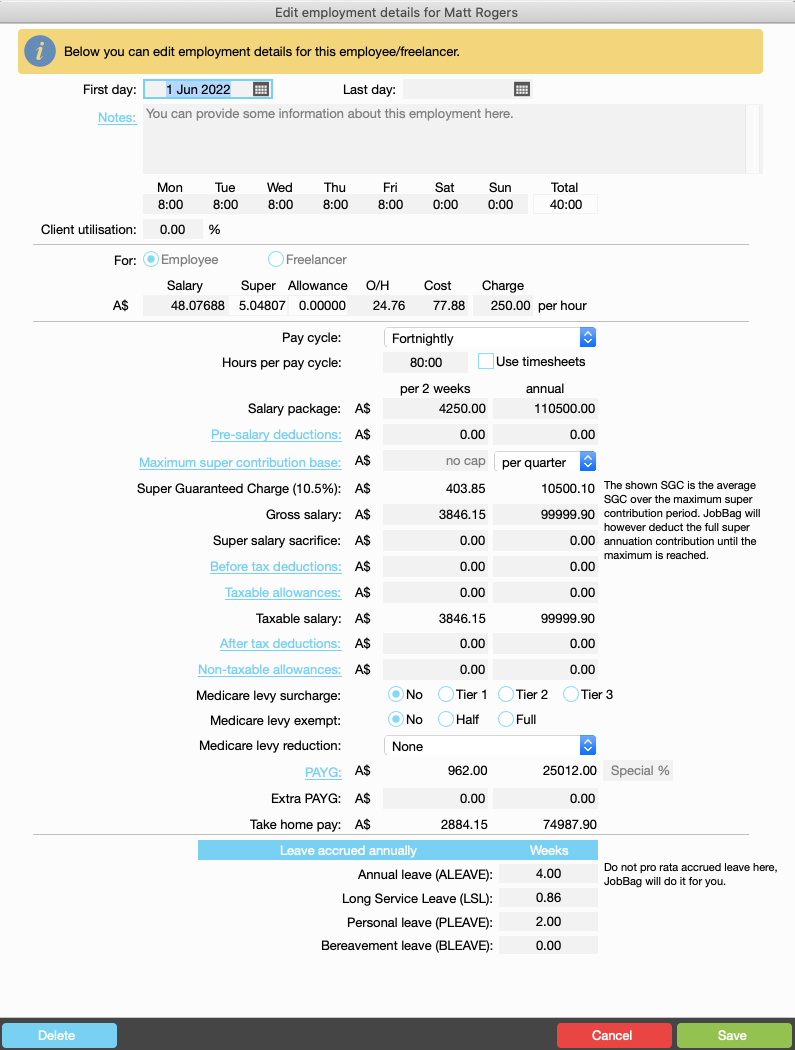

In the employment/PAYG tab select Add new employment info such as hourly rate, cost rate, scheduled hours and days to work, client utilisation rate, pay cycle, salary package, allowances deductions, PAYG calculations, extra PAYG, take home pay and leave entitlements.

Add new tax info

If you have received a signed paper tax declaration form, add the employee's tax information here.

Add new tax event

New employees will complete the New employee form through their myGov Account to advise their payer/employer with their taxation information.

Instructions for new employees about how to complete the new employee form in their myGov account

Instructions to how to retrieve tax info from the ATO

Add Superannuation Fund

Add employees super fund details.

The super fund will need to be set up in the Address book before it can be added to the employment record.

Need more help?

Please contact support, call 02 8115 8090 or email support@jobbag.com