Payroll News Mar 2023

PAID FAMILY AND DOMESTIC VIOLENCE LEAVE

There are rules about how information about paid family and domestic violence leave must be reported on pay slips and what information must not be included. This is to reduce the risk to an employee’s safety when accessing paid family and domestic violence leave.

If an employee has taken a period of paid Family and Domestic Violence Leave (FDVL), employers should record this on their pay slip in a way that makes the pay slip look as close as possible to how it would have looked if the employee had not taken the leave

Click here to learn more about Paid Family and Domestic Violence Leave Regulations 2023

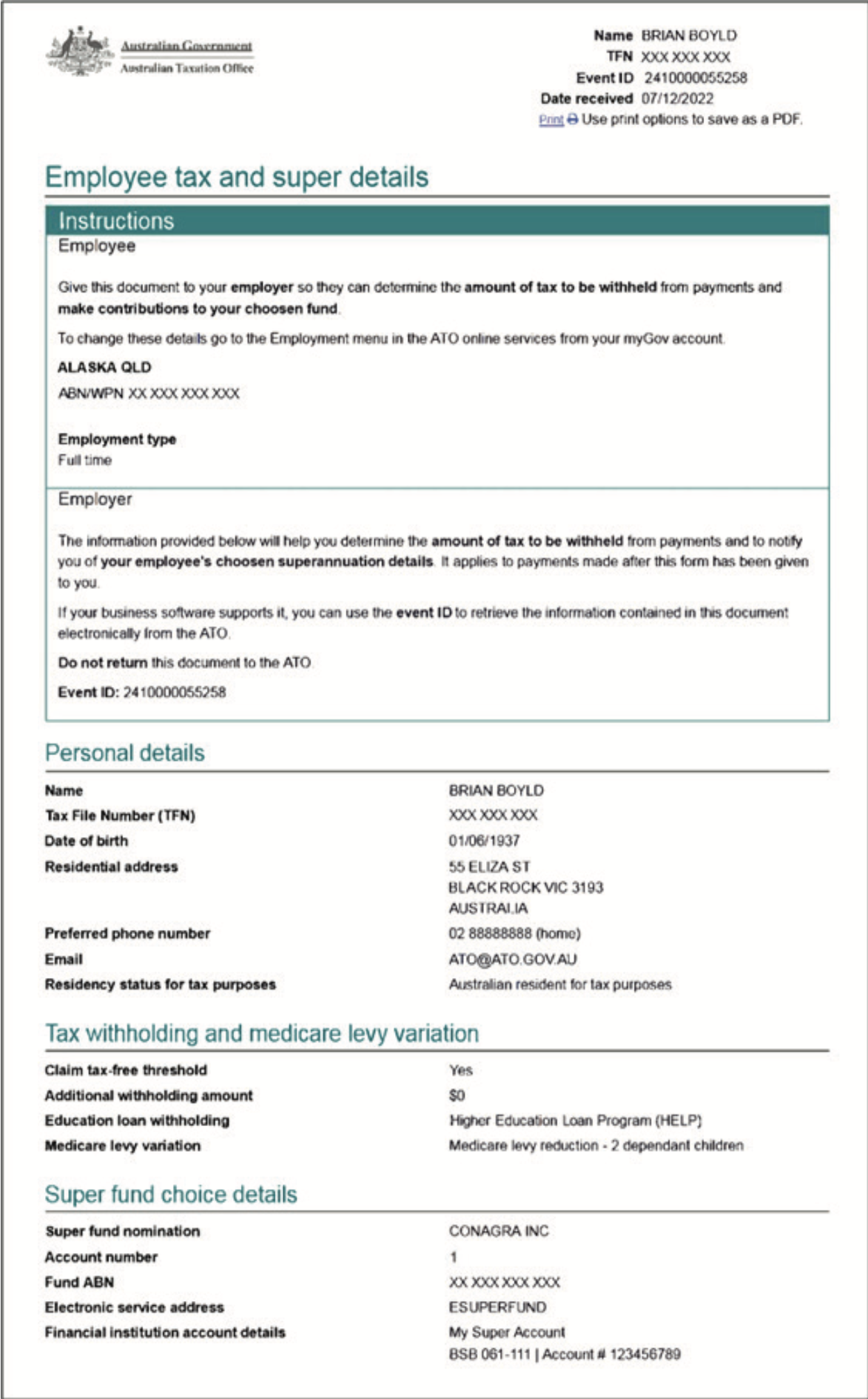

NEW EMPLOYEE TAX AND SUPER DETAILS

The paper version of the Tax Declaration Form will be phased out and removed from the ATO website by the end of the year.

New employees will need to complete the new employment form in myGov and provide a pdf copy of the form to their employer. See example of the form below.

Click here to see Instructions for Employees to complete New Employment Form using myGov

The Payer/Employer will use the event ID to retrieve the employee's tax and super details. This is available now in JobBag.

Click here to see Instructions about how to retrieve employee tax and super information electronically into JobBag

The only exception for using the paper TFN Declaration form after 2023 will be for those payees who do not have internet connection and cannot create a myGov account.

Also check out our new employee on boarding checklist

PUBLIC HOLIDAYS 2023

Just a reminder that public holidays need to be entered into JobBag before you run payroll.

Click here to learn how to Process Public Holidays in JobBag

MAXIMUM QUARTERLY CONTRIBUTION BASE

Did you know Super Guarantee (SG) is capped for employees whose gross earnings is over a certain amount each quarter/year.

The ATO calls this The Maximum Super Contribution Base and sets the maximum contribution base each year.

Check out this link to the ATO for information on the maximum contribution base

Click here to learn how to set this up in JobBag

PLEASE BE AWARE OF THE CLOSURE OF TWO LARGE SUPER FUNDS

These funds closed on the 23rd March 2023 and are no longer accepting contributions.

You will need to update the employees new super details in Jobbag

| BT Super - For Life (BTA0287AU) |

| Asgard Employee Superannuation Account (ASG0007AU) |

HAVE YOU UPGRADED YOUR MOBILE DEVICE RECENTLY?

As new Apple and Android mobile devices are released, you might choose to upgrade to the latest mobile. To ensure your security, you need to Set up your myGovID again and re-verify your identity. Make sure you use your latest myGovID email address.