- 1 Minute to read

- Print

- DarkLight

Configure superannuation rates for payroll

- 1 Minute to read

- Print

- DarkLight

The superannuation rates change from year to year. The rates have to be set for each type of payroll payment eg employee, freelancer and talent. JobBag has updated the rates for the financial year 1 July 2022 to 30 June 2023. The rates have to be added for subsequent years.

The rate is used based on payment date i.e. if a June 2022 payslip is paid in July 2022, the 2022 financial year superannuation rate is used.

Superannuation Rates for Year starting 1 July 2022.

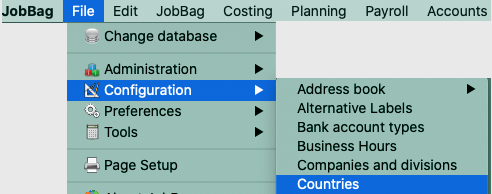

1 Navigate to File > Configuration > Countries

2 Navigate to Australia > Tax tab

Note: New employment info will need to be created for each employee from the 01/07/22

Superannuation Rates for 2023 Onwards

You have to enter the superannuation rates for future years. The process is as follows:

1 Click on edit icon

2 Click on plus sign to add a new rate

3 Add new start date and new rate and click on 'save'

Note: JobBag automatically creates the end date for the previous

Need more help?